Capvisory Insights

Preparing for your Series-A round

Best Practice: The Series-A Fundraising Process

The specialized Berlin-based M&A boutique Capvisory supports startups in Seed and Series-A funding rounds. In this article, we share our practical insights from recent funding rounds in Germany.

Founding Partner

Founding Partner

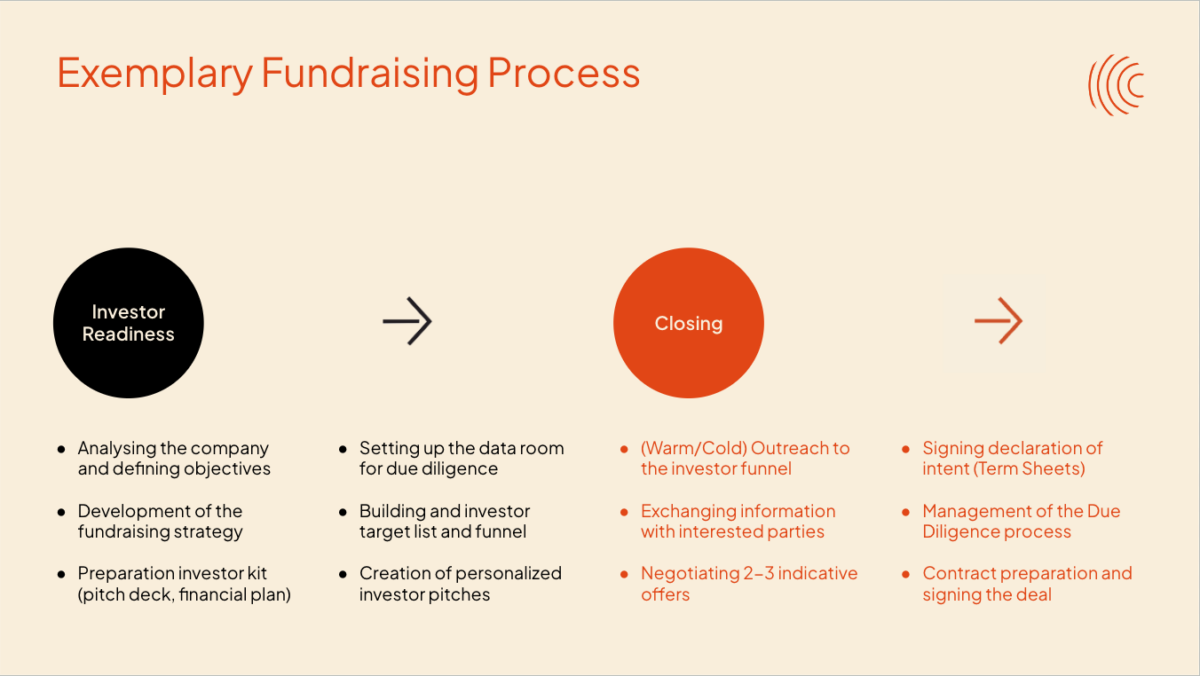

The fundraising process for startups is challenging and consistently ranks among the biggest hurdles founders must overcome. In this insights article, we provide an overview of the typical steps involved in a capital raise in Germany or the DACH region. As a founder, you can use these steps as a checklist for your own round.

Disclaimer: The process varies from company to company, but to reduce complexity, we present only a simplified, standardized outline here.

1. Company Analysis and Goal Setting

Before the actual fundraising begins, a company analysis is essential. During this phase, founders evaluate the current key metrics of the company and set clear objectives for the capital raise.

How much capital is needed, and which milestones should be achieved with it? Is venture capital truly the right form of financing, or would alternatives such as debt financing or crowdfunding be more suitable? Is the company ready to present itself to external investors?

These questions form the foundation of the entire fundraising process and are critical to the success of the funding round.

2. Development of the Fundraising Strategy

Once the current state of the company is analyzed and goals are defined, the fundraising strategy can be developed. The focus for this article is on venture capital financing, although alternative options should also be considered in the initial phase.

Venture capital investors review hundreds of companies annually, evaluating factors such as market attractiveness, competition, go-to-market strategy, the founding team, the skillsets, first hires, and so on. For more innovative products, the product idea takes center stage, whereas for other business models, execution and existing traction are key. A successful fundraising strategy hinges on a profound understanding of the company. It’s essential to present insight effectively, and to craft a compelling equity story that resonates with potential investors.

It’s also crucial to have an in-depth understanding of the VC industry and the mindset of investors. Familiarity with concepts like the venture capital power law, the relationship between a fund and its limited partners, as well as the internal structures and hierarchies of funds, is essential at least at a basic level.

A core component is defining the right target group of investors:

-

- What type of venture capital is suitable for your company? (e.g., venture capital funds, corporate venture capital, private equity)

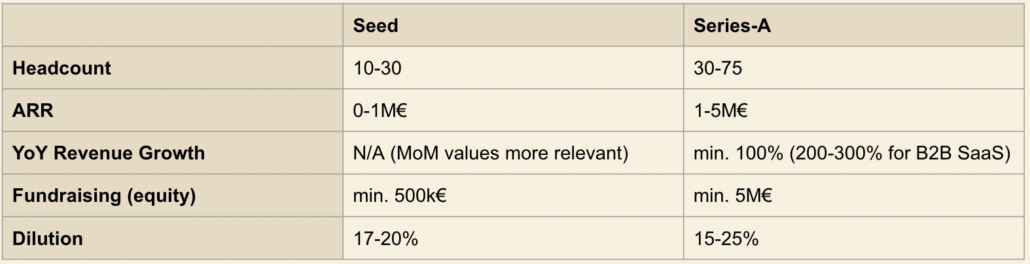

- What stage of funding is your startup in? (Seed, Series A, Series B)

- In which “vertical” is your company active? (e.g., fintech, climate tech, deep tech)

Timing is also critical: raise funds only when you are truly ready and can build momentum, such as through company progress or favorable market conditions. Plan for a period of 6–9 months from the start of the fundraising process to the final transfer of funds. Often, at least one founder works full-time on securing funding. Early involvement of lawyers, tax advisors, and potentially M&A advisors can also be valuable.

Tip: Have you ever wondered which month of the year is the best to approach investors? Check out our article: The Best Timing for Fundraising.

3. Creating the Investor Package (Pitch Deck, Financial Plan)

A pitch deck and financial plan are critical for successfully engaging investors. The pitch deck serves as a “teaser,” succinctly presenting the business idea in an engaging manner to spark interest.

The financial plan provides more depth, presenting detailed historical figures, how the raised capital will be allocated, and the future assumptions the team has made.

Note: The value of an investment memo is often debated. Some founders swear by it, while others find it unnecessary. In our opinion, it can be a helpful supporting document, especially for more complex businesses, but it’s not essential to complete a funding round.

4.Setting Up the Data Room for Due Diligence

Once initial discussions with investors begin, having a well-structured data room is essential. This should include all documents investors need for due diligence, such as financial statements, legal documents, contracts, and other sensitive information.

A well-maintained data room streamlines the review process and fosters trust. Ideally, the data room should be prepared before reaching out to investors so you can respond promptly when interest arises.

5. Researching Suitable Investors

The next step is identifying specific investors within your chosen categories. Thorough research is key. Here are a few typical questions to ask yourself during the research process:

-

- Which investors are active in your industry and region?

- Which investors are engaged in your startup’s development stage (e.g., Seed or Series A)?

- Which investors have made investments in the past 12 months?

- What are the investor’s typical ticket sizes?

-

Who is in charge within the investor’s team for startups in your niche?

Ideally, you already have investors in your network whom you can approach “warm.” If not, and if time permits, attending conferences, networking events, and similar gatherings can be worthwhile to connect with VCs and build relationships before the fundraising phase.

For cold outreach, you can create your own long list, use free online directories (e.g., OpenVC), leverage paid tools such as Pitchbook (quite expensive!) or AddedVal (particularly for business angels), or hire a professional dealmaker or M&A advisor.

At Capvisory, for instance, we maintain an in-house, continuously updated database of over 20,000 investors—from established venture capital funds to lesser-known strategic investors. By closely monitoring relevant funding rounds across Europe, we ensure that we have comprehensive, well-researched investor lists for every industry.

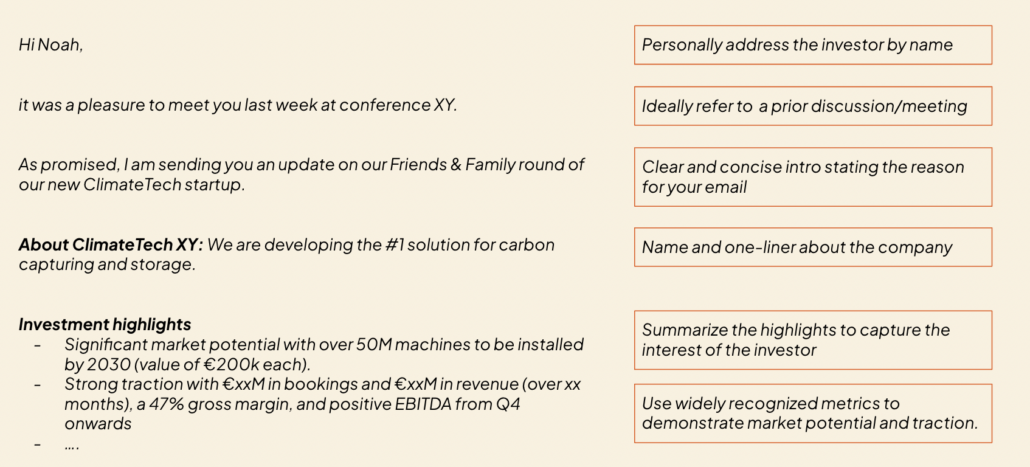

6. Crafting Personalized Outreach Messages

Investors value personalized outreach. Standardized messages are generally insufficient. Instead, each potential investor should be addressed individually. Investors want to see that you have taken the time to understand their unique investment thesis and recognize synergies within their portfolio. This significantly boosts your chances.

Tip: The best outreach is warm, meaning you already know the investor. This significantly increases the likelihood that they will review your company favorably. However, since most founders do not have an extensive network of VC investors, many ultimately resort to cold outreach. Still, as mentioned earlier, attending conferences and startup events is valuable for building your network and getting to know investors personally.

7. Reaching Out to the Investor Funnel

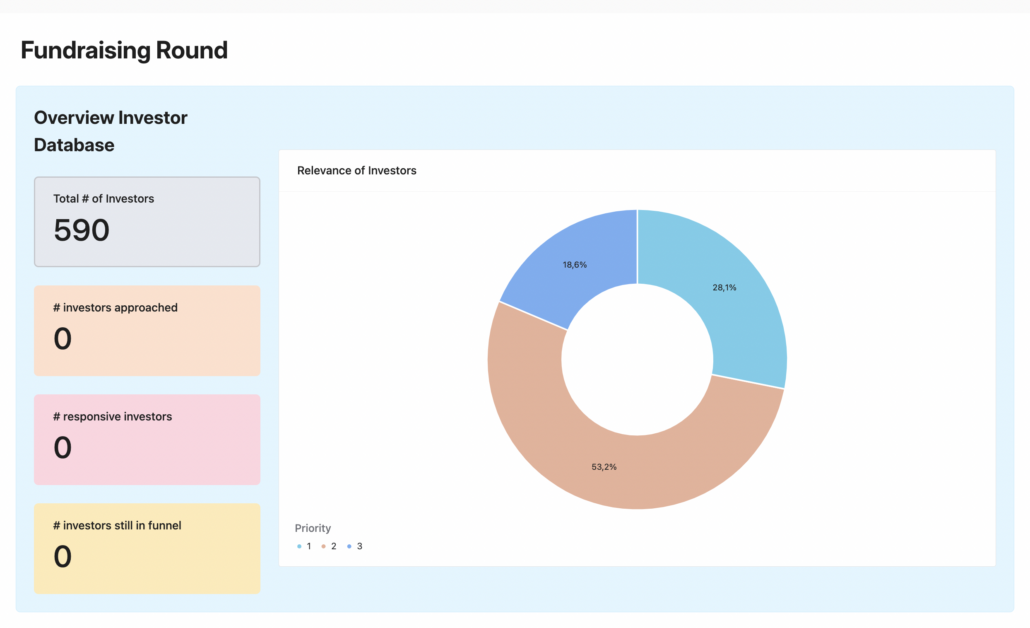

Once all preparations are complete, the active outreach begins. This involves building an investor funnel (similar to a CRM) that enables systematic and efficient contact with investors. The funnel helps track the progress of the fundraising process and ensures that no potential investor is overlooked. Sound familiar to sales? Indeed, investor outreach shares many similarities with a traditional sales process.

For the CRM, you can use ready-made tools or create a custom Excel solution. At Capvisory, for example, we have developed a CRM for founders that is automatically linked to our database of over 20,000 investors and is used for each mandate.

Tip: Cold outreach often means diving into uncharted waters. Most VCs strive to create a positive experience for founders, but there are occasional negative experiences, such as ghosting. Has this happened to you? Check out our article: How Founders Can Professionally Handle Being Ghosted by Investors.

8. Information Exchange with Interested Investors

Investors who express interest typically request additional information. At this stage, it is crucial to respond quickly and accurately. A smooth flow of information builds investor trust and speeds up the decision-making process.

There’s an anecdote about Sam Altman, who, during his tenure as President of Y Combinator, measured founders’ response times to gauge whether someone was a “great or mediocre founder.” You can find the full article here: Sam Altman tracked how quickly people responded to his texts and emails.

9. Negotiating 2–3 Indicative Offers

The goal should be to secure multiple term sheets from potential lead investors. This creates momentum and allows you to negotiate the terms with leverage. Negotiations can become complex if you lack experience in this area.

While established VC investors typically act fairly due to their vested interest in your long-term success, smaller players might behave differently. It’s advisable to have an experienced entrepreneur by your side or seek support from a specialized lawyer or M&A advisor.

10. Signing the Term Sheets

Signing the term sheet is a significant milestone. It is a non-binding letter of intent that outlines the main terms of the investment and must be negotiated carefully. The term sheet forms the basis for drafting the final investment agreements.

In the industry, there is a belief that reputable, professional investors rarely back out of a term sheet unless due diligence uncovers red flags. The probability of closing the deal increases significantly with the signing of the term sheet.

11. Conducting Due Diligence

Following the term sheet’s signing, the due diligence phase begins. During this period, investors thoroughly review all critical aspects of your company, from financials and legal documents to operational structures. This process ensures that the company meets expectations and there are no hidden risks.

As previously mentioned, you should ideally have the data room for due diligence prepared before your investors request access. If you only start assembling it now, significant delays can easily occur due to missing documents that your investor wants to review.

12. Drafting Final Agreements and Signing

Once due diligence is complete, the final investment agreements are drafted (sometimes this happens in parallel to the DD). This step finalizes all details of the investment. After negotiations and the signing at the notary, the initial payment of share capital by investors typically follows within a few days. In some funding rounds, investors transfer both the share capital and the remaining payment into the capital reserve in one lump sum, making the funds available within 1–2 weeks after signing.

However, it is more common for the share capital to be transferred first while waiting for registration with the commercial register. Once the register is updated, investors transfer the remaining amount. Since updating the commercial register can sometimes take longer (in Germany), it may be several weeks before founders have the full amount in their account. Once the complete capital is received, the fundraising process is successfully concluded.

One thought on “The typical Series-A fundraising process for startups”

Comments are closed.