Capvisory Insights

Startup Funding

Non-dilutive funding: Startup financing without dilution

Capvisory, a specialized Berlin-based M&A boutique, advises tech companies on Seed, Series A, and Series B financing rounds, as well as guiding them through exit processes.

Founding Partner

Founding Partner

In the startup ecosystem—especially among younger founders—there’s a common belief that rapid growth is only possible with the backing of venture capital (VC) investors and the associated sale of equity. While VC is undoubtedly a key driver behind many success stories, it’s far from the only path to funding. A closer look reveals a range of compelling alternatives, often grouped under the umbrella of non-dilutive funding. Unlike traditional equity rounds, these options require little to no surrender of company ownership.

In this article, we’ll explore the most common forms of non-dilutive funding, their advantages and risks, and share practical tips on how German startups can successfully tap into these capital sources without giving up equity.

1. What exactly is “non-dilutive funding”?

Non-dilutive funding refers to financing models that allow founders to raise capital without diluting their ownership stakes by bringing in additional investors. Instead, capital is provided through mechanisms like loans, grants, public subsidies, or revenue-based financing.

The key advantage of non-dilutive funding is that founders (and existing investors) retain their proportional ownership in the company—something that can be highly valuable in future equity rounds or when preparing for an exit. Especially in market environments where traditional VC funding becomes more selective or harder to secure, non-dilutive options open up new strategic avenues—provided startups understand how these models work and what’s required to access them.

2. Why is this relevant for founders right now?

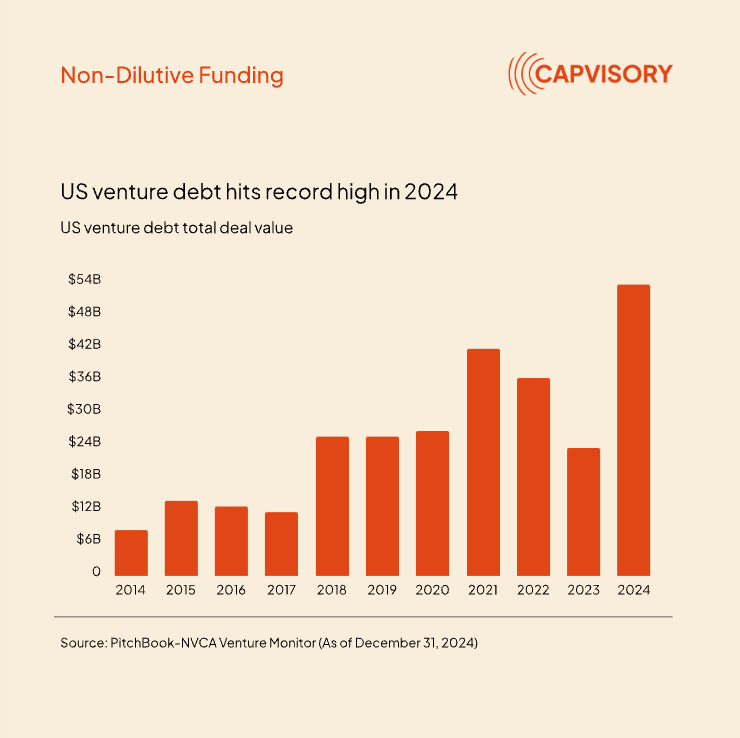

A look at the European market reveals a clear trend: debt and other non-dilutive funding models are gaining traction. In recent months, several high-profile debt financings have made headlines. The reasons are varied—but one key factor is the increasingly cautious stance of many venture capital investors. Here are a few examples of major debt rounds from the past year:

The fact that such massive sums are being raised through debt financing highlights both the growing significance and the untapped potential of this approach. These mega-debt rounds reflect a broader shift in the investor landscape: more capital providers now view scalable tech and sustainability-driven business models as credible borrowers—and are expanding their investment strategies accordingly.

For startups with strong growth metrics, this presents an attractive opportunity: they can raise capital to scale without giving up equity. This is particularly valuable in capital-intensive sectors like energy, biotech, or deep tech, where debt funding can provide the necessary cash flow to fuel the next phase of development.

3. Common types of non-dilutive funding

The range of non-dilutive funding options is broader than many founders initially assume. Below are some of the most relevant instruments:

3.1 Bank loans and government-backed loans

Banks and development institutions offer loans in varying amounts and under different conditions. Traditional bank loans often require collateral such as assets or personal guarantees. Development banks—such as Germany’s KfW—offer subsidized loans specifically designed for young companies.

Upside: No equity dilution.

Downside: Stringent credit requirements and bureaucratic application processes can be challenging.

Founders can apply for these loans through their primary bank or virtually any active financial institution in Germany.

3.2 Venture debt

Venture debt is a form of debt financing tailored specifically for startups. Venture debt providers—either specialized funds or banks—evaluate a startup’s growth prospects and prior VC backing. It’s often an attractive option for startups that have already closed a successful equity round and are looking for additional capital without further dilution.

Compared to traditional loans, interest rates tend to be higher, but venture debt partners often bring experience working with high-growth companies.

Germany has relatively few venture debt providers. Notable examples include P Capital Partners (Sweden), ELF Capital Group (for more mature companies), and Columbia Lake Partners (UK-based).

3.3 Grants and public subsidies

Public funding programs at the EU, national, or regional level—particularly for R&D—often do not require repayment, provided certain conditions are met. These programs can provide substantial capital without forcing founders to give up equity.

However, application and documentation requirements can be time-consuming.

One popular example in Germany is the research tax credit program (Forschungszulage), which supports innovation-focused companies. Many consulting firms now specialize in grant applications, as the approval rates for technologically innovative startups are comparatively high.

3.4 Revenue-based financing (RBF)

In this model, startups receive capital in exchange for a fixed percentage of their monthly revenue. If revenue grows quickly, the loan is repaid faster. If revenue slows, repayments remain manageable. RBF is particularly suitable for SaaS and e-commerce startups seeking flexible, non-dilutive growth capital.

Over the past few years, several fintechs have entered the RBF space. Some—like Berlin-based Remagine—have since gone out of business. A recent article on Finance Forward explores the state of the RBF market: Boom over? What’s next for revenue-based finance fintechs?

Well-known providers include Gilion, Capchase, and Lighter Capital.

3.5 Additional Options

Non-dilutive funding can also include mezzanine financing, accounts receivable financing (factoring), and licensing or partnership deals. In industries like pharma or hardware development, established corporations often provide project-based capital to early-stage startups as part of strategic partnerships

4. Advantages and risks of non-dilutive funding

Key advantages of non-dilutive funding include:

Preservation of ownership: Founders and existing investors retain their equity stake in the company—an important asset in future M&A or exit scenarios.

Faster and less complex: Non-dilutive funding is often simpler and quicker than full-scale VC rounds, as it typically involves fewer negotiations and less extensive due diligence. Of course, it depends on the case. Experienced founders with a strong track record can sometimes move through the VC process quickly as well.

Predictable repayments: Whether it’s interest payments or a share of revenue, repayments follow a clearly defined schedule, which improves financial planning.

Potentially cheaper than equity: This depends on the situation. But when considering dilution and the return expectations of VCs, debt can sometimes be the more cost-effective route—especially public grants, which don’t require repayment at all.

Common downsides include:

Liquidity pressure: Unlike equity, debt must be repaid—with interest—regardless of whether revenue is flowing yet. Taking on debt may also discourage potential investors or buyers. In any case, debt obligations are typically subtracted from a company’s valuation in an M&A context.

Restrictive terms: Larger debt or venture debt deals may include covenants that limit operational flexibility or require the company to maintain certain financial metrics (e.g., EBITDA, cash reserves).

Limited access for early-stage startups: Many lenders expect some level of validation and recurring revenue. Startups in the idea or pre-seed stage may struggle to secure non-dilutive capital.

Bureaucracy: Public funding in particular often comes with heavy documentation requirements, strict deadlines, and lengthy approval processes.

5. Practical tips

When exploring alternatives to VC equity, startups should keep the following in mind:

Clear financial model: Non-dilutive capital providers expect solid financials. Venture debt lenders look at cash flow and revenue growth. Banks focus on creditworthiness and collateral. Public funders want detailed project plans.

Plan for lead time: Whether applying for grants or loans, expect delays. A structured process and clean documentation are essential.

Combine with equity: Non-dilutive funding is often used to complement or bridge between equity rounds. A well-balanced financing strategy improves your chances with debt providers.

Seek advice: If you’re unsure whether non-dilutive funding is the right path, talk to experienced M&A or corporate finance advisors. Peer exchanges with other founders can also provide valuable insights.

6. How do VC investors view non-dilutive funding?

Interestingly, many VCs are not opposed to debt financing. In fact, it can be mutually beneficial when a startup raises additional capital between equity rounds without diluting existing shareholders. The startup boosts liquidity, accelerates growth targets, and potentially increases its valuation for the next round—creating upside for current investors.

That said, high debt levels can be a red flag—especially if it’s unclear how the startup plans to repay. We recommend keeping debt in healthy proportion to the company’s financial performance. If 70% of your revenue is going toward servicing debt, you’re heading into dangerous territory—for both founders and investors.

7. M&A perspective: Non-dilutive funding as an exit lever

From an M&A perspective, non-dilutive funding can be a strategic tool to strengthen your position in exit negotiations. Less dilution usually means founders still hold a meaningful stake—making the cap table more attractive to potential acquirers.

Debt financing can also accelerate growth. The larger the addressable market and the stronger your revenue and profitability metrics, the higher the company’s valuation. In fast-moving sectors like greentech, AI, or SaaS, a well-timed growth push can be a game-changer—provided the debt burden remains manageable.

8. Conclusion and outlook

Non-dilutive funding is not just a short-term trend—it’s becoming a permanent feature of the European startup finance landscape. The headline-making debt financings of 2024—Northvolt, ACC, and Enpal—have drawn founders’ attention to alternatives beyond equity.

Startups that dig into the topic often realize: non-dilutive capital can be a real opportunity to scale without giving up control or too much ownership.

That said, risks should not be underestimated. Debt can quickly become a burden if revenue and cash flow don’t materialize as expected. A careful assessment of the market, competitive landscape, and internal forecasts is essential. Non-dilutive funding works best as part of a broader strategy—one that also includes equity components and leaves room to navigate economic uncertainty

In a nutshell:

-

- Non-dilutive funding (such as loans, grants, venture debt, and revenue-based financing) is a valuable alternative—or complement—to traditional VC rounds.

- Major European deals in 2024 show that institutional lenders are increasingly open to backing tech companies with debt capital.

- Benefits: No equity dilution, greater flexibility.

- Challenges: Interest and repayment obligations, covenants, and often complex application processes.

- Outlook: When combined with equity financing, non-dilutive capital can increase company value and protect founders’ ownership stakes.

- Disclaimer: Non-dilutive funding is an exciting alternative to venture capital. But just like with VCs, it’s the top startups that have the most options, while companies with less innovative models or weak metrics will face an uphill battle here as well.

Frequently asked questions (FAQs)

Non-dilutive funding means raising capital without giving up equity. Common examples include grants, government-backed loans, or revenue-based financing. You stay in control of your cap table—while still securing the resources you need to grow.

Not necessarily. It’s rarely a black-and-white decision—different financing instruments should be seen as complementary. For example, a founder might rely on non-dilutive funding like public grants during the early stages, and then pursue venture capital once there’s solid traction to show.

It depends on your stage and cash flow:

Idea Stage (Pre-Seed / Seed)

Instruments: Scholarships, grants, pitch competitions, crowdfunding

Examples: EXIST, Berlin Business Plan Competition, Kickstarter

Early Revenue (Seed / Series A)

Instruments: Revenue-based financing (RBF), public-backed loans, factoring, initial venture debt, leasing

Examples: KfW ERP Startup Loan, nordwest Factoring, Kreos, Claret

Growth Stage (Series A – C)

- Instruments: Venture debt, private debt, RBF, traditional bank loans, factoring, leasing, trade finance, working capital lines

- Examples: Gilion, SILVR, re:cap, Tradition Meets Future, Pemberton, Kartesia, Sparkasse

While non-dilutive funding protects your equity, it’s never truly “free.” Loans come with interest, RBF takes a cut of your revenue, and grants usually involve heavy paperwork. You’ll often need real traction—not just a great pitch deck. And if revenue drops, repayments can become painful. Bottom line: if VCs aren’t willing to back you, it’s often just as tough to secure favorable terms from non-dilutive providers.

Technically yes—but not without effort. You don’t give up equity, and there’s no repayment. But grants (usually) come with strict eligibility criteria and reporting obligations. They’re great for startups in innovation, health, energy, or impact sectors. Just keep in mind: competition is high, and a strong application is absolutely essential.

Here are a few good places to start:

Revenue-Based Financing – e.g. Gilion, Capchase, Lighter Capital

Venture Debt – e.g. P Capital Partners

In conclusion: Non-dilutive funding is a path every tech startup should at least consider. In a market defined by fierce competition and high capital needs, smart use of debt financing can be the key to gaining a valuable edge—without giving up too much equity or compromising the soul of the company.