Capvisory Insights

Cold Outreach in Fundraising Processes

Startup Fundraising: A/B Testing Response Rates Across Investor Target Groups (VC)

The specialized Berlin-based M&A boutique Capvisory supports startups in late-seed and Series A financing rounds. In this expert article, we share our practical experience.

Founding Partner

Founding Partner

Targeted Outreach in M&A and Startup Fundraising

In M&A processes, and particularly in startup fundraising, targeted outreach to financial investors is a core task. While we at Capvisory, like many founders, prefer to leverage warm networks due to their higher success rates, these networks are often not enough to identify a sufficiently large pool of potential investors. At that point, cold outreach becomes indispensable for many startups seeking to secure suitable capital providers.

Founders frequently approach us with two key questions related to the response and call rates of investors:

- Should founders focus on contacting senior investment team members, such as fund partners, principals, or investment directors, or should they target junior fund staff, like analysts or associates?

- How effective are alternative channels, such as contact forms on websites or central dealflow email addresses like deals@vcfund.com?

To address these questions, we have been analyzing extensive data from our live projects for years. Below, we share the results of our analysis of current mandates from 2025 to help founders maximize the effectiveness of their cold outreach efforts.

Methodology: Analyzing Outreach Channels

To answer these questions systematically, we analyzed data from current fundraising mandates in Capvisory’s impact sector. In total, over 1,300 venture capital contacts were approached through cold outreach, providing a solid foundation for our findings.

The outreach channels analyzed (with roles varying slightly across funds) included:

- Senior Investment Team: Members of senior management, such as managing partners, investment directors, and principals.

- (Junior) Investment Team: Roles like analysts, associates, investment managers, and similar positions.

- Dealflow Email Addresses: Specific addresses for inbound dealflow, such as deals@vcxyz.com.

- Contact Forms: Forms hosted on investors’ websites, such as Typeform.

In addition to tracking the response rate—the percentage of replies to outreach—we also measured the call rate, which reflects the ratio of investors contacted to pitch calls scheduled.

Results of the Analysis

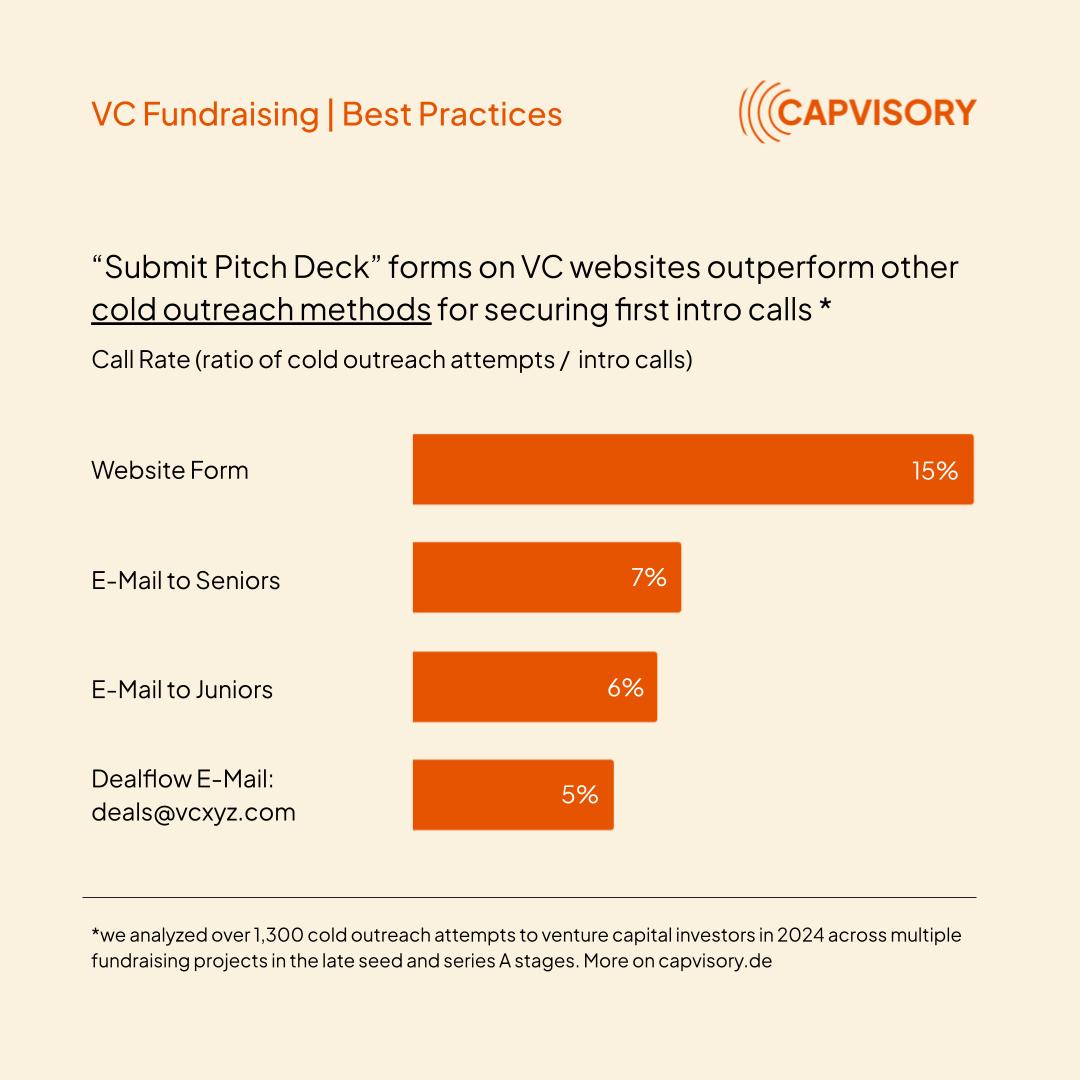

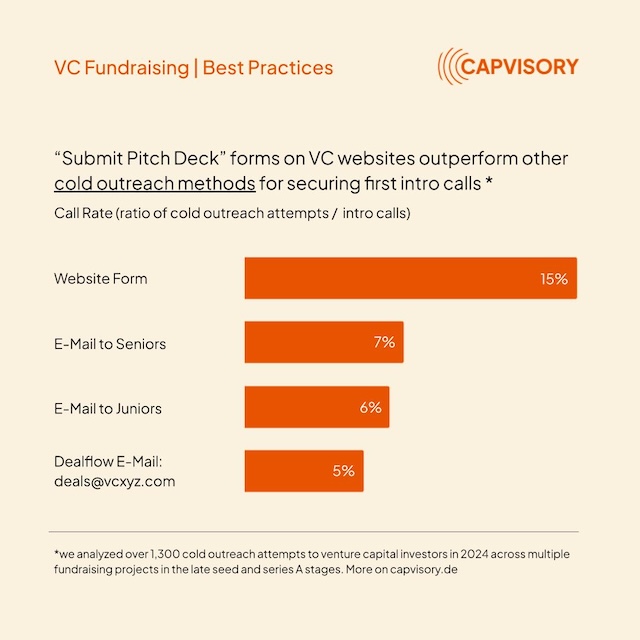

Overall, the data revealed a response rate of over 30% for cold outreach (compared to fundraising benchmarks of 3-20%) and a call rate of 5-15% (benchmarks: 0.5-3%).

Seniors and Juniors Perform Similarly

Our analysis showed that the response rates for senior and junior team members were nearly identical. Contrary to expectations, “the higher the rank, the better the response” does not seem to hold true.

However, junior team members slightly outperformed seniors when it came to call rates. This suggests that juniors, often acting as the first point of contact, are more available and responsible for introductory calls. Senior team members, on the other hand, are typically more involved in later decision-making stages.

Generic Email Addresses Perform Worst

Unsurprisingly, generic email addresses like deals@vcxyz.com performed the worst for both response and call rates. This is likely because such emails are routed to general inboxes, where they are deprioritized or not forwarded to the relevant decision-makers.

Contact Forms as the Most Effective Channel

Surprisingly, contact forms outperformed all other channels in both response and call rates. These forms not only generated replies but also successfully led to pitch calls.

This result is unexpected, as contact forms are often seen as impersonal and less effective at creating a direct connection than tailored emails or phone calls.

One possible explanation is that well-structured forms, especially at larger VCs, are tied to clearly defined and efficient internal processes. These systems ensure that inquiries are systematically reviewed and promptly forwarded to the appropriate decision-makers. This streamlines internal workflows and increases the likelihood of receiving a response.

Conclusions and Recommendations

- Nothing Beats Warm Outreach

Personal connections almost always guarantee a response, and the likelihood of securing an intro call increases significantly. Warm outreach should therefore always be the preferred strategy when engaging with potential investors. - Personalized Cold Outreach Still Works

The good news for founders without a vast network of VC investors: cold outreach remains effective in 2025. However, it requires thorough research and highly personalized messaging to resonate with the target investors. - Use Contact Forms When Available

Our data reveals that contact forms are, in fact, the most effective channel for cold outreach to venture capital investors, both in terms of response rate and securing intro calls. Startups should not overlook this option during outreach efforts. However, it’s important to note that not all VCs provide contact forms. In 2024, only about 1 in 7 investors offer such forms. - Prioritize Reaching Out to Partners When Possible

Our analysis shows that senior and junior team members achieve comparable response and call rates. However, partners are often the ultimate decision-makers. Direct outreach to partners increases the likelihood of connecting with key players rather than getting stuck at the junior level. In the worst-case scenario, your inquiry will be forwarded to the junior team anyway. For this reason, partners should be prioritized in cold outreach.That said, these messages must be highly personalized. Take time to understand the fund’s investment thesis and explore potential synergies within their portfolio. Bonus tip: portfolio companies can also serve as a warm introduction channel.

- Generic Email Addresses as a Last Resort

Generic email addresses should only be used if no direct contacts are available. Their efficiency is significantly lower compared to other outreach methods.

- Nothing Beats Warm Outreach

Conclusion

Structured cold outreach remains an essential part of most fundraising processes, especially in venture capital. Our findings highlight the channels most likely to generate responses and lead to intro calls.

While these results are not universally applicable, startups, M&A advisors, and CFOs can leverage this data to optimize their outreach strategies and maximize their chances of success.