Capvisory Insights

Fund Tracker

Venture Capital 2025: Alle neuen Fonds im Überblick

Die spezialisierte Berliner M&A-Boutique Capvisory unterstützt Startups bei Seed- und Series-A-Finanzierungsrunden sowie im Exit-Prozess. In diesem Fachartikel geben wir eine Übersicht über alle neu geschlossenen VC-Fonds des Jahres 2025.

Gründer und Partner

Gründer und Partner

Der Capvisory Fund Tracker scannt monatlich dutzende Quellen und erfasst neu angekündigte Fonds, die mindestens im First Closing erfolgreich Kapital eingesammelt haben. Ziel ist es, Gründern eine aktuelle Übersicht darüber zu geben, welche Fonds frisch neues Kapital erhalten haben und dementsprechend auch tatsächlich investieren können.

Tipp für Gründer: Wenn ihr gerade auf der Suche nach Risikokapital seid, priorisiert VCs, die in den letzten 1–2 Jahren einen Fonds geschlossen haben. Typischerweise haben diese Investoren noch ordentlich „Dry Powder“, was die Chance auf einen Deal signifikant erhöht.

Der Capvisory Fund Tracker berücksichtigt die Regionen USA, Kanada, Europa und die MENA-Region.

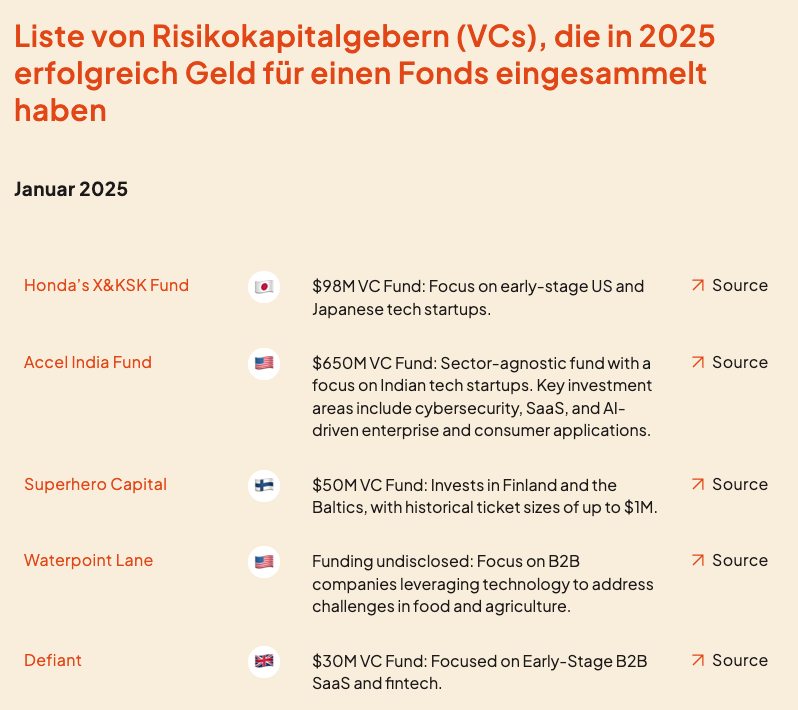

Liste von Risikokapitalgebern (VCs), die in 2025 erfolgreich Geld für einen Fonds eingesammelt haben

Januar 2025

$650M VC Fund: Sector-agnostic fund with a focus on Indian tech startups. Key investment areas include cybersecurity, SaaS, and AI-driven enterprise and consumer applications.

$50M VC Fund: Invests in Finland and the Baltics, with historical ticket sizes of up to $1M.

Funding undisclosed: Focus on B2B companies leveraging technology to address challenges in food and agriculture.

$425M VC Fund: Invests across all areas of medtech, with a focus on medical devices and data science.

$52M first closing: Healthcare-focused VC fund investing in digital health and medtech across Europe, from seed to Series B.

$500M VC Fund: Eli Lilly and Andreessen Horowitz partnership with focus on biotech and healthcare.

$1.2M Angel Fund: Invests mainly in Connecticut-based startups (US).

$255M VC Fund: Targets growth-stage companies in the healthcare sector in North America.

$68M VC Fund: Early-stage fund focusing on sports and entertainment startups.

$12.5B VC Fund: Invests in leading software companies globally, supporting growth at any stage.

$3.2B Expansion Fund: Invests in high-growth, mission-critical SMEs in Europe to create international champions.

$26.6M first close: Sector-agnostic investor focused on Cypriot founders, investing between €100K and €1M, up to Series A.

$100M VC Fund: Invests in defense startups developing military and dual-use technologies.

$25M first close: Targets early-stage quantum technology startups globally, with a final fund target of €60M.

$4.15M VC Fund: Focused on women’s health, including mental health, fertility, menopause, and aging.

$30M VC Fund: Tennis Australia's venture arm, investing in sports, entertainment, media, and health startups at seed to Series A stage.

$110M VC Fund: Invests mainly in AI, but also software, life sciences, and deep tech, from pre-seed to Series A.

$60M first close: Climate tech and deep tech fund focusing on key transition industries such as energy, materials, industrials, and food.

$770M VC Fund: Invests in tech companies in Greater Seattle, the Pacific Northwest, and Silicon Valley across all stages.

$220M VC Fund: Specializes on Series A & B rounds in green mobility, with a focus on Europe and Southeast Asia.

$55.75M VC Fund: Invests in pre-seed and seed-stage healthcare startups, with check sizes ranging from $1M to $2M.

$160M VC Fund: Early-stage, sector-agnostic investor with a total fund target of $400M.

$168M VC Fund: A biotech-focused planetary health fund investing in B2B solutions for food, agriculture, materials, and sustainability.

$122M VC Fund: Invests in New Zealand’s most promising early-stage startups, backing founders launching global companies.

$2M first closing: A pan-European VC investing in pre-seed B2B blockchain startups, with a final fund target of $10M.

$25M VC Fund: Supports startups in Egypt and Africa, helping them scale from ideation to regional and global expansion.

Februar 2025

$125M VC Fund: Invests in hard tech for tough markets, supporting early-stage founders from Europe and Israel in scaling globally.

$500M VC Fund: Sector-agnostic fund split between early-stage investments and follow-ons through Series B and beyond.

$400M VC Fund: Invests in startups with cutting-edge digital technologies, industrial AI, quantum, life sciences, and space tech.

$50M VC Fund: Invests in gaming and app startups at pre-seed and seed stages, leveraging industry expertise.

$230M VC Fund: Supports AI-native 'Software 3.0' companies, investing $1M-$10M at early stages.

$85M VC Fund: Invests at (pre)seed and seed stages in startups from France, Denmark, and Sweden.

$30M VC Fund: Pre-seed and seed-stage crypto venture firm focused on blockchain innovation.

$54M VC Fund: Invests in early-stage software companies at pre-seed, seed, and select Series A rounds, with check sizes of $500K-$1.5M.

$33M VC Fund: Focuses on early-stage investments in frontier tech, including energy, space, robotics, and semiconductors.

$615M VC Fund: Invests in high-growth companies through fund investments, direct deals, and solution-oriented secondaries.

$300M VC Fund: Invests €10M-€50M in growth buyouts and tech growth deals across France and Southern Europe.

$744M VC Fund: Focuses on climate tech and decarbonization, backed by Japanese industrial and financial institutions.

$115M VC Fund: Invests in non-listed European SMEs and scale-ups focused on the energy transition.

$8.6M VC Fund: Germany’s first alumni fund, investing in (pre)seed startups from CDTM with a network of 300+ LPs.

$150M VC Fund: Invests in early-stage tech across LegalTech, Fintech, Risk & Compliance, and Media.

$50M first closing: VC focused on healthcare transformation through technology, supporting early-stage startups.

$100M VC Fund: Nordic Fund II backs founders at inception, investing €300K in two tranches.

$208M VC Fund: Seed-stage investor with a focus on data-driven decision-making and diverse founders.

$67M VC Fund: Climate tech investor supporting the next global leaders in sustainability.

$1.6M VC Fund: Early-stage investor focusing on sustainable startups with acceleration support.

$249M VC Fund: Invests in climate tech companies from seed to Series A.

$75M VC Fund: Nordic-focused investor in life sciences and technology startups.

$30M VC Fund: Sector-agnostic VC investing in early-stage startups across MENA and U.S.-based AI.

$105M VC Fund: Focuses on consumer health innovation, shifting healthcare from reactive to proactive.

$46M first closing: Early-stage VC deploying €250K-€2M per ticket across scalable tech startups.

$6.6M VC Fund: Invests $100K-$200K at pre-seed and seed stages, aiming for 30 companies in Fund I.

$172M VC Fund: Invests in Series A & B rounds, focusing on underinvested entrepreneurs.

$400M VC Fund: Invests in early-growth enterprise technology companies.

$528M VC Fund: Invests across all stages of clinical development, focusing on high-impact biotech.

$29.5M VC Fund: Backs pre-seed startups with gender-diverse founding teams in ClimateTech, FemTech, HealthTech, FinTech, and HR Tech.

$40M VC Fund: Supports the startup ecosystem in Saarland with direct investments and fund-of-funds strategies.

$210M VC Fund: Prioritizes B2B SaaS businesses with $3M-$20M in recurring revenue, focusing on PLG and inbound models.

$126M VC Fund: Invests in the Cambridge startup ecosystem, supporting early-stage deep tech and life sciences.

$42M VC Fund: European-focused fund investing at early stages, open to Series A, with flexible initial tickets up to €1M.

$225M VC Fund: Leads and co-leads Seed and Series A rounds in consumer tech and enterprise consumerization.

$185M VC Fund: Backs product-oriented founders at pre-seed, focusing on software startups.

Funding undisclosed: VC firm connecting Silicon Valley and Southeast Asia investors, focused on climate tech, supply chain, and health tech.

$245M VC Fund: Invests exclusively in B2B software at the seed stage, making ~10 investments per year.

Funding undisclosed: Pre-seed VC fund supporting early-stage biotech startups with capital, lab space, and mentorship.

$100M VC Fund: Supports SME growth in Romania, focusing on healthcare, B2B services, retail, and niche manufacturing.

$50M VC Fund: Invests in ‘Built in Africa for the World’ companies, leveraging proprietary deal flow data.

$664M VC Funds: Invests in top-performing venture funds and companies across sectors, geographies, and blockchain.

$60M VC Fund: Invests in creator-led businesses across multiple verticals, emphasizing brand and content-driven growth.

$6.3M first closing: VC focuses on sovereign early-stage startups with military applications, excluding controversial weapons.

$190M VC Fund: Invests in early-stage companies and technologies through its Venture and Growth Capital fund.

März 2025

Undisclosed VC Fund: Invests from Seed to Series B in aviation and transportation tech, launched by NYC-based Vantage Group.

$100M VC Fund: Backs AI startups reshaping the energy sector for a more efficient and resilient grid.

Undisclosed VC Fund: Focuses on connected devices, automotive, and mobility solutions, typically investing at Seed stage and beyond.

$20M VC Fund: Targets early-stage “social discovery” startups to foster next-gen social platforms and communities.

$20M VC Fund: Invests Seed to Series B across LATAM, Africa, MENAP in O2O, B2B SaaS, and FinTech, leveraging Yango’s global presence.

$22.5M VC Fund: Early-stage investor with a hands-on approach, focusing on fewer startups for deep operational support.

$175M VC Fund: Invests in early-stage deep tech and biotech, out of Boston, with $500M total AUM.

$62M second close (target $100M VC Fund): Seed-stage enterprise software investor with a global approach; invests through Series A.

$64M VC Fund: Early-stage investments in the Alpine region, partnering with regional asset managers and entrepreneurs.

$300M VC Fund: Focuses on Seed to Series A in manufacturing, logistics, transportation, defense, and energy.

$40M VC Fund: Doubles down on foodtech, digital health, and enterprise SaaS, especially in the Midwest.

$200M VC Fund: Research-led approach to climate tech for urban environments, typically writing Series A checks.

$215M first close (target $270M VC Fund): Emphasizes science-driven innovation for the next wave of breakthroughs.

$110M first close (target $130M VC Fund): Invests in European software and AI-driven data ventures, typically early-stage to Series A.

$175M VC Fund: Pre-seed and Seed, sector-agnostic with a strong software focus; big believers in AI.

$600M VC Fund: Hunts “$0B markets” in enterprise, AI, fintech, and crypto—backing founders who create entirely new markets.

$1B VC Fund: B2B software powerhouse, fueling iconic SaaS companies and building on its enterprise track record.

$152M VC Fund: Europe-focused investor in cybersecurity, applied AI, digital infrastructure, hardware, digital health, and space.

$25M first close (target $80M VC Fund): Seed/early deep-tech/hard-tech across the US Southwest and Northwest Europe.

Undisclosed VC Fund: Super-early investing in Finland, Sweden, and Estonia, with active follow-ons.

$998M VC Fund: Early- to growth-stage, focusing on supply chain, logistics, and transformative tech, based in Austin.

$350M VC Fund: Backs founders at the earliest stages in AI-enabled services, SaaS, fintech, digital health, and cybersecurity.

$1.2B VC Fund: Major European life sciences investor fueling healthcare and biotech innovation.

$107M VC Fund: Amsterdam-based VC focused on Web3 and blockchain ventures.

$81M VC Fund: Invests in automation, AI, carbon capture, electrification, and low-carbon materials for net zero.

$177M VC Fund: Invests in early-stage B2B companies transforming enterprise, healthcare, and financial services.

$190M VC Fund: Palo Alto-based investor targeting enterprise AI, healthcare, and industrial automation startups.

Undisclosed VC Fund: Porto-based cybersecurity and infrastructure software VC, investing globally.

$50M VC Fund: Blockchain-focused firm backing RWAs, DeFi, PayFi, and consumer Web3 apps.

$181.8M VC Fund: Backs consumer, commerce, and culture startups across the US.

$13M VC Fund: Seeks “big ideas solving big problems” in SaaS, fintech, healthcare, platforms, and deeptech.

$85M VC Fund: Targets proven climate and decarbonization tech—clean energy, resilient infrastructure, and sustainable land use.

$175M VC Fund: Invests in natural climate solutions to reduce emissions across agriculture and beyond.

$24M VC Fund: UK-based, invests Pre-Seed/Seed in B2B SaaS and consumer tech.

$56M VC Fund: Seed-stage fintech investor fueling financial resilience solutions.

$25M first close (target $50M VC Fund): Cleveland-based firm backing Seed & Series A startups in Ohio.

$100M VC Fund: Dubai-based venture builder backing AI-focused tech startups worldwide.

$200M VC Fund: NYC-based firm investing in software, fintech, digital infrastructure, and healthcare IT.

$55M VC Fund: Climate-tech investor for Sub-Saharan Africa across energy, agriculture, and mobility.

$50M second close: Early-stage MENA focus in fintech, healthtech, edtech, and sustainability.

$54M VC Fund: Backs sustainable startups in Europe with climate-friendly and social impact.

$50M first close (target $100M VC Fund): Targets maritime supply chain to digitize and decarbonize shipping.

Undisclosed VC Fund: Co-builds and invests in sustainable, profitable, and impactful ventures.

$27M VC Fund: Stockholm-based investor accelerating European SaaS, embedded finance, and fintech scaleups.

$27M VC Fund: Early-stage backer of games tech for next-gen interactive entertainment.

$35M VC Fund: Early-stage digital health and fast-tracked medical devices.

$20M VC Fund: Seed investments across AI, fintech, mobility, and sustainability, focused on European founders.

April 2025

$340M first close Venture-Debt Fund: Growth loans for European tech scale-ups.

$22M VC Fund: Late-stage Israeli deep-tech in AI, cyber, semiconductors & deep-tech.

$75M first close VC Fund: Defence-aligned deep-tech and critical-infrastructure startups.

$30M Seed Fund ($50M target): Enterprise & deep-tech deals across Southeast Asia.

$350M Fund: Venture debt & growth equity for later-stage tech and healthcare.

$66M Founder-Fellowship Fund: €500k tickets for elite “founder prodigies” scaling globally.

$11M VC Fund: Pre-seed deep-tech & B2B in Germany’s Ruhr region.

$66M VC Fund: Early-stage life-science & deep-tech in Northern England.

$22M Venture-Building Fund: Backs Ukrainian defence tech in EW, unmanned systems & smart materials.

$75M VC Fund: AI & SaaS startups with strong India-US go-to-market bridge.

Undisclosed Development Fund: Innovation & development in Western Romania.

$86M first close VC Fund: Fintech, B2B SaaS, cyber & health-tech with “Seed Pocket” for pre-seed gems.

$360M VC Fund: Operator-led capital for mission-critical enterprise software scale-ups.

$7M VC Fund: Asset-light software decarbonising transport, buildings & energy.

$16.5M second close VC Fund: Fintech & B2B software across Kazakhstan-Bangladesh corridor.

$262.5M VC Fund: Early-stage, hands-on investors in cloud infra, security, AI & data.

$27.5M VC Fund: Late-seed/Series-A B2B marketplaces modernising global supply chains.

Mai 2025

$5.8M VC Fund (first close): Pre-Seed fintech & SaaS in emerging hubs.

Juni 2025

undisclosed (First Close), $11M (Target) VC Fund: Seed-stage investments in startups developing Type-1-Diabetes healthtech solutions.

Accelerator: Canadian innovation hub supporting deep-tech founders.

$900M VC Fund: Backing technical founders building tools for devs, data teams & ML engineers.

$5.8M (First Close), $11,4M (Target) VC Fund: Early-stage biotech across Europe & beyond.

$15.7M VC Fund: Backing early-stage ventures in Europe & US across marketplaces, consumer platforms & consumerised SaaS.

$75M VC Fund: For improving economic mobility, healthcare access & resilient community infrastructure.

$100M (Target) VC Fund: Robotics & automation for industrial transformation.

$41M VC Fund: Co-building deep-tech startups to bring government-grade cybersecurity innovation to market.

$20M VC Fund: Seed-stage US fund focused on founder DNA and operator-driven ventures.

$900M VC Fund: Multi-stage fund for AI, healthtech & frontier innovation globally.

$105M CVC Fund: Strategic bets in enterprise IT & digital transformation.

$300M (est.) VC Fund: Life‑sciences venture fund backing Canadian medtech & biotech innovation.

$34.5M (First Close), $115M (Target) VC Fund: Early-stage across the Baltics.

undisclosed (First Close), $40M (Target) VC Fund: Fintech from Seed to Series B.

$30M (First Close), $100M (Target) VC Fund: Equity & credit bets in regulated-market tech.

$25M VC Fund: Midwest tech and social impact innovation.

$46M (First Close), $92M (Target) VC Fund: Agri & food-tech innovation across the Nordics.

$68.4M VC Fund: Spinouts from UK northern universities.

$80.5M (First Close), $115M (Target) Debt Fund: Growth debt for underbanked tech firms.

$34.5M (First Close), $115M (Target) VC Fund: Quantum-tech commercialization.

$12.7M (First Close), $34.5M (Target) Fund: Early growth capital for European tech scale-ups.

undisclosed VC Fund: Gen-Z brands at the intersection of culture, creators & community.

undisclosed VC Fund: Investing in disruptive technologies across defense, energy & dual-use.

$30M (First Close), $60M (Target) VC Fund: Midwest-focused early-stage startups.

$115M VC Fund: Family office backing European tech founders long-term from seed to growth.

Juli 2025

$46M (First Close), $100M (Target) VC Fund: Backing the next wave of Nordic-founded global tech leaders.

$200M VC Fund: Invests across the biotech lifecycle from pre-proof-of-concept to advanced clinical stages.

(Undisclosed) VC Fund: Funds and supports AI-enabled roll-ups across multiple industries.

(Undisclosed) VC Fund: Focus on entertainment, wellness, consumer innovation, and longevity ventures.

$26M VC Fund: Pre-seed and seed investments in AI-powered Health, FinTech, Commerce & Future-of-Work startups.

$30M VC Fund: Sector-agnostic investments exclusively in teams with at least one female founder.

$60M VC Fund: Accelerator and growth tickets up to €1M+ for Balkan startups from pre-seed to Series A.

$10M VC Fund: Pre-seed investor in AI-native infrastructure and application startups.

$66M VC Fund: Fund III invests in early-stage AI startups, agents & native AI interfaces.

$25M VC Fund: Pan-European early-stage investor in FinTech, Cleantech & Web3.

$250M VC Fund: $0.5M–$15M checks for technical founders building the "autonomous enterprise".

$283M VC Fund: Sixth life-sciences fund backing emerging biomedical technologies in ANZ.

Undisclosed First Close, $57M (Target) VC Fund: Data-driven ClimateTech & Future-of-Work investor.

$400M VC Fund: Focus on repeat founders spinning transformative healthcare companies out of top universities.

(Undisclosed) VC Fund: Seed-to-early-growth investments in robotics, automation, industrial AI & energy tech.

$75.8M VC Fund: Tackles plastic pollution via circular-economy investments in Latin America & Caribbean.

$300M Employee Liquidity Fund: Purchases vested stocks from talent across Cyberstarts portfolio.

$15M (First Close) VC Fund: Pan-European defence tech supporting Ukraine & EU re-armament.

$100M VC Fund: Series A-focused investor in Bitcoin-centric software; selective pre-seed & seed participation.

$751M (First Close), $1B (Target) VC Fund: AI Growth Fund IV backing European tech champions.

$355M VC Fund: Series B & growth-stage fund focused on B2B tech across EU & NA.

$180M VC Fund: Pre-seed & seed investor in AI-native infra, security & enterprise software.

$100M VC Fund: $0.5-2M early-stage checks in cybersecurity, AI, frontier tech & healthtech.

$116M VC Fund: Boosts deep-tech startups within the NUS innovation ecosystem.

$120M VC Fund: Third fund investing in early-stage AI-based Israeli startups (cyber, fintech, mobility).

$150M VC Fund: Solo-GP backing early-stage AI-driven category-creators across Indian sectors.

$250M VC Fund: Backs infrastructure enabling tokenization of real-world assets.

$34M VC Fund: Early-stage investor exclusively in Y Combinator alumni companies.

$100M VC Fund: Seed investor in the infrastructure and enablers of tomorrow’s economy.

$120M VC Fund: Planetary Health Fund investing in resource, energy & productivity innovations.

$320M VC Fund: Leads Series A-C rounds in early-growth Israeli tech.

(Undisclosed) VC Fund: Invests in capital-efficient B2B SaaS & AI companies in underserved Mid-Atlantic markets.

$16M VC Fund: Pre-seed & seed backing of Stanford-linked founder CEOs with 360° people-ops support.

$106M (First Close), $163M (Target) VC Fund: Pre-seed & seed impact tech in energy, food, mobility & agri.

Undisclosed (First Close), $50M (Target) VC Fund: Supports Israeli consumer startups from seed to Series A.

$685M Venture Debt: Asset-based private credit for high-growth tech-enabled companies.

$57M VC Fund: Focus on pre-seed & seed tech startups based in the Rhineland/NRW region as well as the Euregio Meuse-Rhine.

(Undisclosed) VC Fund: Invests in early-stage industrial & energy tech startups, spin-out from CSL Capital.

$326M VC Fund: Seed-and-lead investor in healthcare, IT & physical sciences; >$1B AUM.

Undisclosed VC Fund: Midwest investor writing $0.5M-$4M checks in healthcare, climate, consumer & community.

(Undisclosed) Accelerator Fund: Co-invests in ethical pre-seed & seed startups via new UK investor hub.

Undisclosed (First Close), $33M (Target) VC Fund: Early-stage support for Portuguese & European startups.

$175M VC Fund: Sector-agnostic debut fund making 8-10 core tech investments with high-profile LP backing.

$11.5M VC Fund: Early-stage fund investing in startups based in Ruhrgebiet (Ruhr area within Germany).

$100M (First Close), $250M (Target) VC Fund: Digital infrastructure tech transforming industrial sectors.

August 2025

$4M VC Fund: Seed and early-stage enterprise software and advanced technology nationwide.

$425M VC Fund: Seed & growth capital for Australia and New Zealand tech founders.

undisclosed VC Fund: AI First Fund backing AI-native startups built around LLMs, agents, and proprietary data.

$200M VC Fund: Industrial innovation in advanced manufacturing, ag-tech, extractives, and critical minerals.

undisclosed VC Fund: Community-powered early-stage investor backing impact-aware, globally ambitious founders.

$115M VC Fund: Invests in University of Cambridge spinouts in deep tech and life sciences.

$56.8M (First Close), $174M (Target) VC Fund: UK net-zero solutions in energy, mobility, and built environment.

$750M VC Fund: Leads seed and Series A in consumer, devtools, and AI for cybersecurity.

$360M VC Fund: Credit union-backed fintech investments via Curql Fund II.

$93.33M VC Fund: Financial services innovation at seed and early growth.

$93M VC Fund: Evergreen fund backing Danish research-driven/deep tech startups from pre-seed to scale-up.

$430M VC Fund: Digitally enabled climate solutions in energy and industrial technology.

$18M VC Fund: Fintech, healthtech, and insurtech leveraging GenAI and machine learning.

$45M VC Fund: Early-stage defense, energy, supply chain, and manufacturing technologies for mission-critical industries.

undisclosed VC Fund: Pre-seed crypto-native investments in decentralized infrastructure, AI, middleware, and apps.

$1.3B VC Fund: Company creation and early-stage biotech, focused on novel therapeutics.

undisclosed (First Close), $50M (Target) VC Fund: Growth-stage tech, consumer, and industrials via primary and secondary deals.

$18M VC Fund: Early-stage Canadian deep tech and enterprise software; seed and Series A.

$200M VC Fund: Seed and early-stage biopharma, medical devices, and healthtech.

$40M VC Fund: Longevity fund investing in radical life extension technologies.

$265M VC Fund: Continuation vehicle backing select Lakestar portfolio companies.

undisclosed VC Fund: Early-stage hydrogen economy technologies across production, storage, and mobility.

$66.61M VC Fund: Resilience tech across energy, industry, logistics, construction, food, healthcare, security, and climate.

undisclosed VC Fund: Women’s Health Fund IV investing across women-specific, differential, and disproportionate conditions.

$29M (First Close), $70M (Target) VC Fund: Global quantum tech investments beyond the Dutch ecosystem.

$25M VC Fund: B2B software, tech-enabled services, life sciences, and healthcare across Series A–C and select growth.

$30M VC Fund: Pre-seed and seed B2B SaaS, AI applications, software infrastructure, and energy in DACH.

$300M VC Fund: Corporate VC backing early-stage U.S. fintech and AI in banking, payments, and wealth.

$20M VC Fund: Early-stage African startups in fintech, mobility, agri-tech, logistics, and sustainability.

undisclosed VC Fund: Flexible equity solutions for growth-stage technology companies; backed by TPG NEXT.

$60M VC Fund: Dual-use national security technologies at early stages.

$10M VC Fund: Backs low-cap crypto projects and second-round financing within its Web3 ecosystem.

September 2025

$61.6M VC Fund: Invests in early-stage fintechs, meeting the needs of financially underserved people globally.

$100M VC Fund: Early-stage venture fund, backing crypto founders disrupting the status quo.

$588M VC Fund: Invests in growth companies (Series B onwards or via secondaries) with tickets of €10–30M, and early VC funds.

$400M VC Fund: Opportunity Fund that provides capital to portfolio companies advancing biotech innovation.

$370M VC Fund: Sector-agnostic early-stage fund (Fund IV: $120M) and Growth Fund ($250M) investing in technology companies across the Gulf region.

$152M (First Close), $234M (Target) VC Fund: Growth equity supercharging South European tech scale-ups for international expansion.

undisclosed VC Fund: CVC investing in smart living hardware & software (industrial tech, green buildings, autonomous technologies).

$150M VC Fund: Debut fund investing in AI-first and technology-driven companies solving humanity’s pressing challenges.

$87.65M VC Fund: Invests in deep tech founders (from biotech to space travel).

undisclosed VC Fund: Invests in B2B Software, AI, and Data companies.

$410M (Second Close) Venture Debt Fund: Provides growth debt to finance European tech and life sciences companies.

$88M VC Fund: Generalist pre-Seed specialist, backing up to 50 companies across the UK and Europe.

undisclosed VC Fund: Backs platforms and technologies shaping the AI ecosystem and next frontier of computing.

$380M VC Fund: Opportunity Fund supporting portfolio companies scaling to global, growth-stage cybersecurity leaders.

$58M (First Close), $76M (Target) VC Fund: Backs Vertical AI, recommerce, and marketplaces.

$41M VC Fund: Early-stage venture fund focused on infrastructure startups (developer tools & infrastructure in the age of AI).

$110M (First Close), $164M (Target) VC Fund: Focused on European security, cybersecurity, AI, quantum, and defence.

undisclosed VC Fund: Early-stage investor in AI-driven enterprise innovation in Northern Europe.

$100M VC Fund: Seed fund for AI infrastructure, agentic business applications, and native AI apps.

$30M (First Close), $100M (Target) VC Fund: AI-native healthtech focused on female performance across sports, longevity, and wellness.

$500M VC Fund: Backs startups in cybersecurity, AI, and enterprise software.

$305M VC Fund: Deeptech investor scaling companies in EU strategic sectors (Industry 4.0, AI, cybersecurity, semiconductors, mobility, new materials).

undisclosed VC Fund: Invests in generational companies and accelerates them with executive hires (Software/AI focus).

$30M VC Fund: Venture studio supporting creation & development of next-gen healthcare projects.

$35M (First Close), $58M (Target) VC Fund: Early-stage DACH startups with an AI-focused mission.

$60M VC Fund: Partners with founders defining whole-person health; AI as an enablement layer.

$130M VC Fund: Backs Europe’s best business software & fintech companies through venture and growth stages.

$150M VC Fund: Fund by oneworld alliance and Breakthrough Energy Ventures to advance & commercialize sustainable aviation fuel technologies.

$24M VC Fund: Generalist pre-seed & seed across Baltics/Nordics; software, science, and the “hard stuff.”

$100M VC Fund: Global AI innovation fund targeting AI startups worldwide.

$587M VC Fund: Invests across EU & US tech — software, AI, healthcare, fintech, gaming (direct, primary, secondary).

$560M VC Fund: Invests at the intersection of national security and commercial enterprise (space, autonomy, cyber, advanced sensing, AI-enabled systems).

$29M VC Fund: Dedicated Blue Economy fund tackling ocean challenges (marine intelligence, smart ports, offshore wind, blue biotech).

undisclosed VC Fund: Concentrated portfolio at the frontiers of multiple industries; long-term view.

$625M VC Fund: Accelerates investment in biotech and digital health innovation.

$15M VC Fund: Venture builder co-creating ventures with Canadian leaders; Canada-focused.

$40M VC Fund: Invests in AI & climate tech to build sustainable high-growth companies.

$35M VC Fund: Continuation vehicle acquiring select stakes from existing portfolios to provide LP liquidity.

$30M VC Fund: Invests in energy, industry, and robotics amid soaring global electricity demand.

$425M VC Fund: Leads Series A rounds in top post-PMF companies (generalist).

$246M VC Fund: Climate Tech fund for expansion-stage companies driving energy transition & industrial decarbonization in Europe.

$75.5M VC Fund: Intersection of technology and biology — biotech, techbio, and tech-enabled services.

$330M VC Fund: Early-growth AI-powered software; data moats and product flywheels focus.

$670M VC Fund: Toyota subsidiary investing in early-stage startups; access to Toyota assets & expertise.

$54.5M VC Fund: Circular Economy Growth Fund scaling technologies to eliminate waste and reduce GHG emissions.

$22M VC Fund: Invests in seed-stage startups with a focus on AI, B2B SaaS, and healthtech by Polish founders.

$205M VC Fund: Backs Europe's next wave of tech startups; focuses on Vertical AI, Digital Health, Industrial Software, Cyber Security and Sovereignty.

$80M VC Fund: Supports early-stage healthcare innovations; helps companies harness discoveries to deliver precise, personalized care and reduce costs (Midwest-based).

undisclosed VC Fund: Focuses on early-stage fintech and SaaS investments across MENA (payments infrastructure, digital banking, proptech, insurtech, etc.).

$58M VC Fund: Invests in EU early-stage founders working on grids, storage, and downstream applications in mobility, industry, and real estate.

$135M VC Fund: Focuses on new innovations in energy, mobility, buildings, and industry to drive resilient, decarbonized systems.

$25M (First Close), $50M (Target) VC Fund: North American Seed Fund designed to back high-potential startups from pre-seed through seed stages across the US and Canada.

$800M VC Fund: Targets 20-25 new investments in Series B to late-stage companies developing AI, automation, climate technology, energy, and sustainability.

undisclosed VC Fund: Supercharges early-stage Israeli startups expanding into the US market across multiple industries.

October 2025

tba soon

Frequently asked questions (FAQs)

Bei Capvisory haben wir keine bereits bestehende, zuverlässige, kontinuierlich aktualisierte und kostengünstige Quelle gefunden, die neue VC Fonds abbildet. Auch Gründer:innen stoßen häufig auf teure, veraltete oder unvollständige Listen, die nicht zeigen, wer tatsächlich investiert. Deshalb haben wir mit unserem Fund Tracker ein Live-Dashboard entwickelt, das aktive Fonds sichtbar macht – speziell zugeschnitten auf Startups in der Fundraising-Phase oder im Exit Prozess. Aus unserer Erfahrung entscheidet die Qualität der Investorendaten oft darüber, ob ein Fundraising-Prozess reibungslos oder frustrierend verläuft.

Wir konzentrieren uns ausschließlich auf Venture Capital Fonds, die kürzlich ein Closing bekanntgegeben haben und denen damit tatsächlich Kapital zur Verfügung steht. Fonds, die lediglich ihren Launch ankündigen, aber noch keine Mittel eingesammelt haben, lassen wir bewusst außen vor damit Gründer:innen keine Zeit verlieren, indem sie mit Investoren sprechen, die in echt garnicht investieren können.

Außerdem bemühen wir uns, Fonds auszuschließen, die unseriös wirken oder wenig transparent agieren.

Der Capvisory Fund Tracker umfasst derzeit aktive Fonds aus den USA, Kanada, Europa und der MENA-Region.

Melde dich gern bei uns. Wir geben die Rohdaten in der Regel nicht direkt heraus – aber wenn wir uns kennengelernt haben, stellen wir dir gern eine auf dein Startup zugeschnittene Liste relevanter Fonds zusammen.

Wir crawlen dutzende Branchenquellen und beziehen Daten aus verschiedenen Datenbanken und Newslettern. Jeder Fonds wird manuell über Pressemitteilungen, LinkedIn und offizielle Websites verifiziert – so stellen wir eine möglichst hohe Datenqualität sicher.

Trotzdem können wir nicht garantieren, dass uns jeder neue Fonds auffällt. Falls dir ein fehlender Fonds auffällt, freuen wir uns sehr über einen Hinweis!

Capvisory ist eine Fundraising und Exit Beratung für Startups. Unser Fund Tracker unterstützt diese Mission, indem er mehr Transparenz in die VC-Landschaft bringt und unser Investor-CRM kontinuierlich mit aktuellen, hochwertigen Daten versorgt.

Weitere Fragen zum Fund Tracker?

Ihr habt Input für uns, wollt einen Fonds nachtragen oder interessiert euch für die Daten hinter der Liste? Meldet euch gerne unter hi@capvisory.de.