Capvisory Insights

Series: Code of Conduct for VCs

How founders can professionally handle being ghosted by investors

At Capvisory, we support ambitious startups with their Seed and Series A funding rounds. In this article, we share insights from our hands-on experience.

Founding Partner

Founding Partner

This article is part of our “VC Code of Conduct” series, where we aim to highlight the experiences of our founders during fundraising processes and promote respectful behavior within the VC industry.

What Does “Ghosting” Mean in the VC Context?

“Very exciting, we’ll get back to you by next week.” Every founder has heard it before. Days pass, and after two weeks, you follow up – with no response.

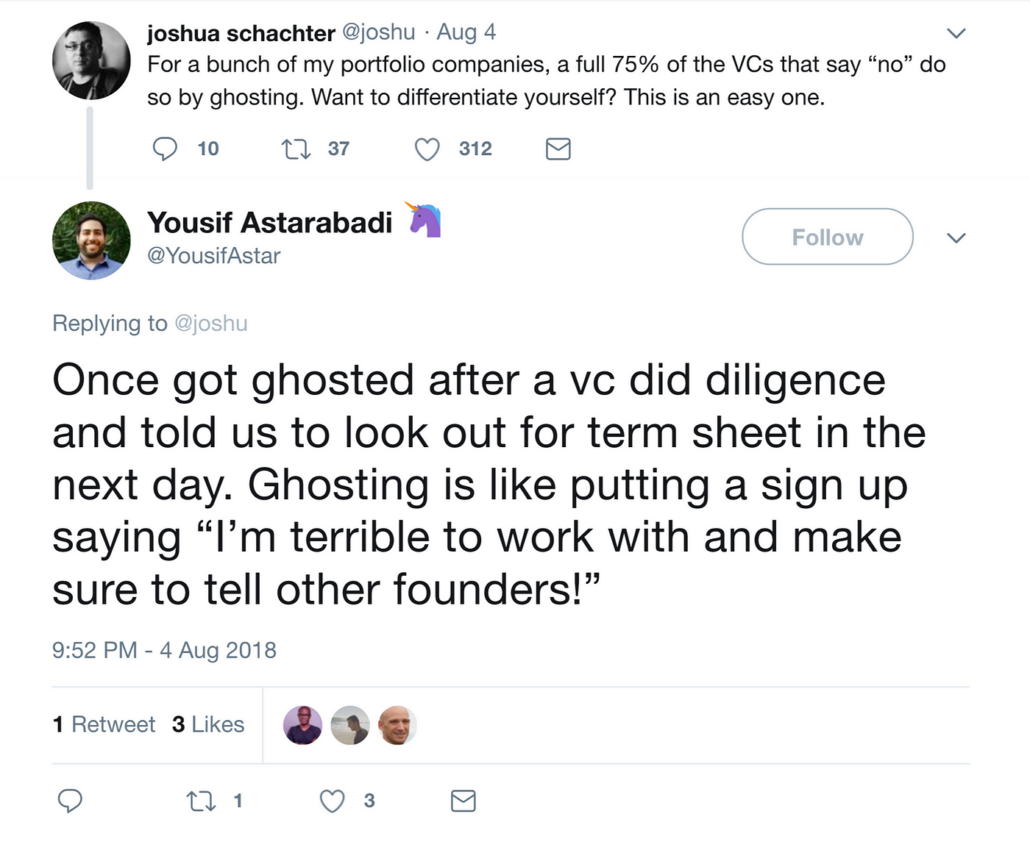

Ghosting occurs when an investor, who previously showed interest, suddenly cuts off communication. This often happens after what seemed like promising conversations. For founders, this means waiting for an answer that, in the worst case, never comes.

Why Does Ghosting Happen?

There are many reasons why investors suddenly stop responding. Here’s a non-exhaustive list:

- Overwhelming workload: Many VCs receive hundreds of emails and pitches daily and are often simply overwhelmed, making it difficult to respond to everyone.

- Uncertainty: VCs may be unsure whether they want to invest and avoid giving a firm “no” to keep their options open in case they decide to join later.

- Strategic waiting: Some VCs wait to see if a lead investor or other investors show interest before making a decision.

- Fear of confrontation: It can be uncomfortable to reject someone, especially if it could lead to discussions or justifications. Some investors prefer to avoid communication altogether.

- Lack of internal processes: Smaller funds or family offices often lack clear structures and systems to follow up on pitches or provide rejections.

- Delaying for better terms: By stalling communication, VCs might wait until the startup’s financial situation worsens, giving them better leverage in negotiations.

- Internal crises or zombie funds: Sometimes, the investor isn’t truly active or is dealing with internal problems that aren’t communicated. They continue discussions to keep up appearances but are not in a position to act.

At Capvisory, we support startups during fundraising and have learned from experience: even the best startups experience ghosting. It’s not uncommon for 5-10 out of 100 contacted investors to suddenly break off communication without explanation. But no matter the reason, ghosting should not happen.

Why Is Ghosting So Problematic?

Ghosting is problematic for founders for several reasons. First, they lose valuable time, often waiting weeks for a response that could be spent elsewhere.

Then there’s the uncertainty. Without any feedback, it’s unclear whether the pitch or the presentation had issues, or if the investor simply lost interest. This uncertainty makes it difficult to plan the next steps in the fundraising process.

Moreover, the ongoing silence can severely impact the founders’ morale. The lack of feedback leads to demotivation and self-doubt, making it harder to approach the next challenges with full commitment.

For VCs, the risk lies in damaging their market reputation. Founders are less likely to return to a VC with a new idea or recommend them if they’ve been ghosted in the past. This can negatively impact deal flow.

Additionally, careless handling of deals can lead to missed opportunities, which they may later regret.

Our advice

To avoid ghosting, founders should start with thorough research. Before reaching out to an investor, make sure the VC is a good fit for your industry, stage, and is still actively investing. A targeted approach reduces the risk of engaging with investors who may be more prone to ghosting.

Building a strong network is also crucial. Relationships within the VC ecosystem are invaluable. A warm introduction or direct connection can help you avoid cold outreach and increase your chances of a respectful response.

Patience is key. After your meeting, give the investor one to two weeks to follow up, as they are often managing multiple projects simultaneously. If you haven’t heard back, send a polite reminder, remaining respectful and professional.

If there’s no response after four weeks, it’s time to move on. Consider that investor a “lost lead” and focus on others. Keep the door open for future conversations, but don’t waste any more time.

What can VCs do better?

- Set clear expectations: VCs should communicate realistic timelines and next steps from the first meeting, so founders know what to expect. If the team is small and needs more time, that’s fine—just be transparent.

- Implement better tools: Using a CRM system or support from EAs can help track pitches and ensure timely responses. This can also be measured in internal KPIs.

- Expand capacity: If deal flow becomes overwhelming, VCs should bring on additional resources like junior analysts or assistants to streamline the pitch and communication process.

- Review internal guidelines: Establish and regularly update clear team behaviors, especially for new employees, to ensure consistent communication with founders.

Conclusion: Stay Professional

Ghosting is a frustrating, but unfortunately common, part of the fundraising process. The key is not to get discouraged and to always remain professional and polite. Don’t take the behavior personally—be honest with yourself and acknowledge that the investor probably isn’t interested in your startup.

For the sake of completeness: Misconduct can also happen on the founders’ side and can harm VCs. Be fair to each other.

We maintain a list of funds where we’ve observed problematic behavior and report on these patterns in our VC Code of Conduct series.