Capvisory Insights

Venture capital exclusively for German startups

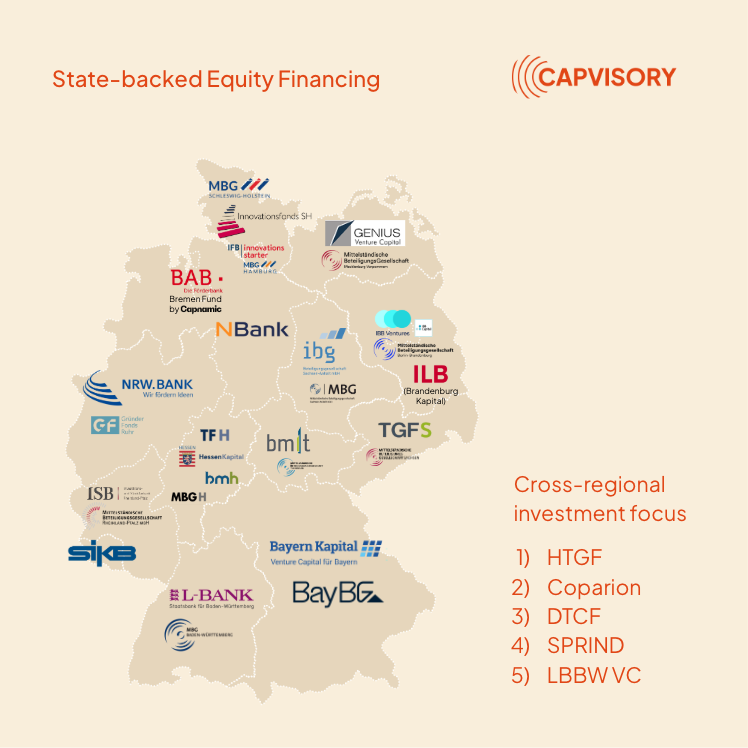

Top 45 state-backed venture capital investors you should know in Germany

Capvisory is an independent, founder-led advisory boutique specializing in fundraising, sell-side M&A, and buy-side M&A for fast-growing tech companies and their investors.

Founding Partner

Founding Partner

These government-backed VCs complement private investors and provide startups based in Germany with valuable opportunities to secure competitive funding.

At Capvisory, we have integrated these so-called “matching facilities” into several fundraising projects, collaborating with funds such as HTGF, IBB, ILB, BayernCapital, and various MBGs.

The landscape of government-backed venture capital in Germany is complex and heavily influenced by federalism. Each state prioritizes the topic differently and maintains its own investment funds. This is where our updated Capvisory List 2025 comes in: As experts in fundraising and exit processes for tech startups, we provide a concise overview to help founders quickly identify the right contacts in their region.

State-backed venture capital can be broadly categorized into four groups:

- National (semi-)governmental VC funds investing directly (e.g., High-Tech Gründerfonds)

- Regional (semi-)governmental VC funds investing directly (e.g., IBB Ventures)

- State-level SME investment companies, known as ‘Mittelständische Beteiligungsgesellschaften’ (MBGs) (e.g., BayBG, MBG Baden-Württemberg)

- Private VC funds with a public institution as anchor investor (e.g., Gründerfonds Ruhr)

- Fund-of-funds and institutional investors (e.g., KfW Capital)

This article focuses on regional and national (semi-)governmental VC funds that invest directly in startups, private VCs with a public institution as anchor investors, as well as state-level SME investment companies (MBGs). For founders, this list serves as a valuable resource to find the right investor for their next funding round.

Why does state-backed venture capital exist?

The German government provides equity capital through various funds and instruments to support innovative startups and SMEs. Early-stage startups, in particular, often struggle to secure venture capital. Publicly funded VCs help bridge this funding gap—especially in strategically important industries such as Deep Tech, ClimateTech, Life Sciences, and Defense. In contrast, these funds rarely invest in sectors like Consumer, Lifestyle, or Web 3.0.

How do state-backed VC investments work?

State-backed investment firms often act as co-investors, partnering with private VC funds or business angels. In most cases, the private investor matching is structured at 30/70 or 50/50, meaning startups may only need to raise 30% from private investors to receive 70% in government-backed capital. However, the application, selection, and due diligence process is generally the same as with traditional venture investors.

Many of these funds focus on Seed or Series A rounds, often with the potential for follow-on investments. An exception is the DTCF, which enters at a later stage, offering investments starting at €10 million.

Each government-backed investment firm has specific focus areas, often aligned with political priorities and economic trends. Currently, many funds prioritize Green Tech, Climate Tech, Deep Tech, Energy, and Artificial Intelligence (AI). In recent years, Defense Tech has also gained momentum.

Mezzanine capital & silent partnerships: Beyond traditional equity investments, some government-backed funds also offer hybrid financing structures, such as mezzanine capital or silent partnerships.

The 5 major nationwide state-backed VC funds in Germany

These state-backed VC investors operate on a nationwide level in Germany. Every startup seeking venture capital should be aware of these players.

1. High-Tech Gründerfonds (HTGF)

Stage: Pre-Seed, Seed

Ticket Size: Up to €1 million in the first round, up to €30 million in follow-ons

Industry Focus: Digital Tech, Industrial Tech, Life Sciences, Chemistry & adjacent fields

Geographic Focus: Germany (only German startups)

Sponsor: Federal Ministry for Economic Affairs and Climate Action, KfW Capital & private investors

2. Coparion (in its original form)

Stage: Seed, Series A, Series B

Ticket Size: Co-investments up to €15 million per startup (50% of the round must come from private investors)

Industry Focus: Sector-agnostic

Geographic Focus: Germany (only German startups)

Sponsor: KfW Capital, ERP special fund, private banks

3. DeepTech & Climate Fund (DTCF)

Stage: Series A and beyond

Ticket Size: Start at €10 million per investment (acts as an anchor investor alongside private investors)

Industry Focus: Deep Tech, Industrial Tech, Computing, Climate, Life Sciences & adjacent fields

Geographic Focus: Germany (only German startups)

Sponsor: Zukunftsfonds, ERP special fund, KfW Capital

4. SPRIND – German Agency for Breakthrough Innovations

Stage: “Early-stage innovation projects”

Ticket Size: Various funding instruments, often up to €1 million

Industry Focus: Sector-agnostic, focused on “breakthrough innovations”

Geographic Focus: Germany & EFTA countries

Sponsor: Federal Ministry of Education and Research (BMBF) & Federal Ministry for Economic Affairs and Climate Action (BMWK)

5. LBBW Venture Capital

Stage: Seed, Series A

Ticket Size: Up to €3 million

Industry Focus: Enterprise IT, IoT, Industry 4.0, AI/ML, FinTech, Big Data & Analytics in various industrial sectors, drug development, diagnostics, MedTech, and Healthcare IT

Geographical Focus: DACH region

Sponsor: Landesbank Baden-Württemberg (LBBW)

Since 2023, the KfW has been offering also the “Venture Tech Growth Financing (VTGF)” program, a government-backed debt financing option for young, technology-driven growth companies with VC funding that receive private loans or venture debt from professional institutions.

Insights from our experience with state-backed VCs

At Capvisory, we have supported multiple fundraising rounds involving state-backed investment funds and have had the opportunity to connect with many fund managers. Naturally, we are particularly active in Berlin with IBB Ventures, but we have also collaborated with others such as IFB Innovationsstarter GmbH in Hamburg, HTGF or NBank Capital.

Key takeaways from working with state-backed VCs:

Great opportunity for local startups: State-backed VCs often have a strong regional focus, specifically supporting startups from their respective areas. This provides local startups with funding opportunities they might not receive from nationwide or purely private VCs.

Co-investments with private investors: State-backed VCs rarely invest alone—they typically match private investments or act as co-investors. This can be highly beneficial if your startup has already secured commitments from private investors. Additionally, the ability to double the invested capital is a strong argument when convincing private investors to participate. Most regions have well-known and respected private investors, and their commitment signals credibility to the state-backed VC.

Slower processes compared to private VCs: Unlike fully private investors, state-backed funds are bound by bureaucratic approval processes. This can lead to longer due diligence and delayed investment decisions, making the funding process slower than with private VCs.

Capital availability even in downturns: Since these funds are publicly financed, their investment decisions are less dependent on market cycles compared to private VCs. Even in challenging years, when private investors become more cautious, state-backed VCs can continue investing within their pre-allocated budgets.

Tip for Founders: Start by reaching out to your regional state-backed VC, development bank, or mid-sized investment company (Mittelständische Beteiligungsgesellschaft). These institutions oversee most funding programs and offer the fastest and most tailored advice. Taking this step early makes sense—first, because their due diligence process can take time, and second, because a soft commitment from them can serve as a catalyst for converting private investors.

The 19 most important regional state-backed venture capital firms in Germany (2025)

Most state-backed regional investment firms—aside from MBGs—are funded by federal states or are subsidiaries of regional development banks. These development banks are state-owned or semi-public financial institutions, primarily financed through federal or state funds. They pursue economic policy objectives and are not profit-oriented.

Below is a list of the most important regional players, including their stage focus, ticket sizes, and industry specializations.

-

- IBB Ventures (Berlin)

Stage: Seed and Series A

Ticket Size: Up to €1 million initially, follow-up investments up to €5 million

Industry Focus: Software & IT, Healthcare, Industrial Technologies, Consumer & Digital, Impact

Geographical Focus: Berlin

Sponsor: Investitionsbank Berlin (IBB) - Bayern Kapital (Bavaria)

Stage: Seed and growth financing

Ticket Size: €250,000 to €25 million

Industry Focus: Biotechnology, Life Sciences, Medical Technology, Software & IT, Environmental Technology, Nanotechnology, Materials & New Materials

Geographical Focus: Bavaria

Sponsor: LfA Förderbank Bayern - NRW.BANK Venture Fonds (North Rhine-Westphalia)

Stage: Seed to growth financing

Ticket Size: Up to €15 million (initial investment up to €5 million)

Industry Focus: Climate Tech, Information and Communication Technologies (ICT), Artificial Intelligence (AI), Enterprise Software, SaaS, IT Security, Life Sciences (Diagnostics, Pharmaceuticals, Medical Technology), Robotics, Photonics, New Materials, Digitalization of Industry, Economy, and Administration, Digital Business, as well as innovative business models

Geographical Focus: North Rhine-Westphalia

Sponsor: NRW.BANK - Gründerfonds Ruhr (North Rhine-Westphalia)

Stage: Seed

Ticket Size: undisclosed

Industry Focus: Sector-agnostic, with a particular interest in B2B tech in Life Sciences, Cybersecurity, and Industry 4.0

Geographic Focus: Nationwide in Germany, with a special focus on the Ruhr region

Sponsor: Private investors and NRW.BANK as anchor investor. - Brandenburg Kapital (Brandenburg)

Stage: Seed to Series B

Ticket Size: Up to €7.5 million

Industry Focus: Industry, Information and Communication Technology (ICT), Healthcare, Life Sciences

Geographical Focus: Brandenburg

Sponsor: Investitionsbank des Landes Brandenburg (ILB) - IFB Innovationsstarter GmbH (Hamburg)

Stage: Seed, Series A

Ticket Size: Up to €7 million

Industry Focus: Industry-agnostic

Geographical Focus: Hamburg

Sponsor: Investitions- und Förderbank Hamburg (IFB Hamburg) - Saarländische Wagnisfinanzierungsgesellschaft (SWG) (Saarland)

Stage: Seed, Series A

Ticket Size: Up to €2 million

Industry Focus: Industry-agnostic

Geographical Focus: Saarland

Sponsor: Saarländische Investitionskreditbank AG (SIKB) - Technologiegründerfonds Sachsen (TGFS) (Saxony)

Stage: Seed, Series A

Ticket Size: Up to €5 million

Industry Focus: ICT (Software/Industry 4.0/IoT/Big Data Analysis), Semiconductor and Microsystem Technology, Medical Technology/Health Sciences, Electronics, Sensors, New Materials, New Media, Cleantech

Geographical Focus: Saxony

Sponsor: Free State of Saxony, Sächsische Aufbaubank - IBG Beteiligungsgesellschaft Sachsen-Anhalt (Saxony-Anhalt)

Stage: Seed, Series A, Series B

Ticket Size: Up to €10 million per investment

Industry Focus: Energy, Mechanical and Plant Engineering, Resource Efficiency, Healthcare and Medicine, Mobility and Logistics, Chemistry and Bioeconomy, Nutrition and Agriculture

Geographical Focus: Saxony-Anhalt

Sponsor: State of Saxony-Anhalt

Management: bmp Ventures - GENIUS Venture Capital GmbH (Mecklenburg-Western Pomerania)

Stage: Pre-Seed, Seed, Series A

Ticket Size: Up to €1.5 million per investment

Industry Focus: Industry-agnostic, but focused on ICT, Life Sciences, Environmental and Energy Technology, Mechanical Engineering

Geographical Focus: Mecklenburg-Western Pomerania

Sponsor: Technologie- und Gewerbezentrum e.V. Schwerin/Wismar - Innovationsfonds Schleswig-Holstein (Schleswig-Holstein)

Stage: Not specified

Ticket Size: Up to €1 million per investment

Industry Focus: Industry-agnostic

Geographical Focus: Schleswig-Holstein

Sponsor: Investitionsbank Schleswig-Holstein (IB.SH), MBG Schleswig-Holstein mbH - NBank Capital (Lower Saxony)

Stage: Seed to mid-sized companies

Ticket Size: Not specified

Industry Focus: Industry-agnostic

Geographical Focus: Lower Saxony

Sponsor: Investitions- und Förderbank Niedersachsen (NBank) - BBM (BAB Beteiligungs- und Managementgesellschaft Bremen mbH) (Bremen)

Stage: Seed, Series A

Ticket Size: Up to €1.5 million per investment

Industry Focus: Industry-agnostic

Geographic Focus: Bremen

Sponsor: Bremer Aufbau-Bank (BAB) - Capnamic Specialty Fund Bremen (Bremen)

Stage: Seed, Series A

Ticket Size: Up to €2 million per investment

Industry Focus: Aerospace, Logistics, Nutrition, AI, or relevant key industries

Geographical Focus: Bremen

Sponsor: Capnamic, Sparkasse Bremen, Bremer Aufbau-Bank (BAB)

Management: Capnamic - Hessen Kapital III (Hesse)

Stage: Seed, Series A

Ticket Size: €0.1 to €1.5 million

Industry Focus: Industry-agnostic

Geographical Focus: Hesse

Sponsor: BMH Beteiligungs-Managementgesellschaft Hessen mbH - Technologiefonds Hessen (TFH) (Hesse)

Stage: Late Seed, Series A

Ticket Size: Up to €2 million

Industry Focus: IT, Fintech, Insurtech, Life Sciences, Deep Tech, IoT, Cleantech, with a specific focus on sustainable models

Geographical Focus: Hesse

Sponsor: BMH Beteiligungs-Managementgesellschaft Hessen mbH - bm|t Beteiligungsmanagement Thüringen GmbH (Thuringia)

Stage: Seed to mid-sized companies (Revenue <€75 million)

Ticket Size: Up to €10 million

Industry Focus: Industry-agnostic (including Life Sciences, IT, Optoelectronics)

Geographical Focus: Thuringia

Sponsor: Thüringer Aufbaubank - Innovationsfonds Rheinland-Pfalz III (Rhineland-Palatinate)

Stage: Seed to mid-sized companies (Revenue <€75 million)

Ticket Size: Up to €10 million

Industry Focus: Industry-agnostic (including Life Sciences, IT, Optoelectronics)

Geographical Focus: Rhineland-Palatinate

Sponsor: Investitions- und Strukturbank Rheinland-Pfalz (ISB) - L-Bank Investment Program (Baden-Württemberg)

Stage: Startups and mid-sized companies

Ticket Size: Up to €7.5 million

Industry Focus: Industry-agnostic

Geographic Focus: DACH region

Backer: L-Bank – State Bank of Baden-Württemberg

- IBB Ventures (Berlin)

List of the 13 regional investment companies (Mittelständische Beteiligungsgesellschaften (MBG)) from which we know they work with starups

The MBGs are typically private institutions with close ties to SMEs, often backed by chambers of commerce, banks, or industry associations. They are funded through returns from previous investments, public funds, and private investors.

Below are the MBGs that we know work with startups:

-

- MBG Baden-Württemberg (Baden-Württemberg)

Stage: Seed to Series A financing, SMEs

Ticket Size: €0.2 to €3.0 million

Industry Focus: Innovative and technology-oriented startups

Geographical Focus: Baden-Württemberg

Website: www.mbg.de/venture-capital/ - BayBG Bayerische Beteiligungsgesellschaft mbH (Bavaria)

Stage: Pre-Series A to Series B, SMEs

Ticket Size: Up to €5 million initial investment

Industry Focus: Industry-agnostic

Geographical Focus: Bavaria

Website: www.baybg-vc.de - MBG Berlin-Brandenburg (Berlin and Brandenburg)

Stage: Startup founders and SMEs

Ticket Size: Individual, depending on the chosen program

Industry Focus: Industry-agnostic

Geographical Focus: Berlin and Brandenburg

Website: www.mbg-bb.de - MBG Schleswig-Holstein (Schleswig-Holstein)

Stage: Seed to growth financing, SMEs

Ticket Size: Up to €1 million

Industry Focus: Industry-agnostic

Geographical Focus: Schleswig-Holstein

Website: www.mbg-sh.de - MBG Hamburg (Hamburg)

Stage: Startup foundation, Seed, Series A, SMEs

Ticket Size: Up to €2.5 million

Industry Focus: Industry-agnostic

Geographical Focus: Hamburg

Website: www.mbg-hh.de - MBG Hessen (Hesse)

Stage: Early stage, growth, SMEs

Ticket Size: Up to €10 million, depending on the specific fund

Industry Focus: Industry-agnostic; support for technology-oriented ventures

Geographical Focus: Hesse

Website: www.bmh-hessen.de - MBG Mecklenburg-Vorpommern (Mecklenburg-Western Pomerania)

Stage: R&D phase to market launch, SMEs

Ticket Size: Up to €1.5 million

Industry Focus: Industry-agnostic

Geographical Focus: Mecklenburg-Western Pomerania

Website: www.mbg-mv.de/programme/mv-innostartvc - MBG Niedersachsen (Lower Saxony)

Stage: Startup foundation, SMEs

Ticket Size: Up to €0.2 million

Industry Focus: Industry-agnostic

Geographical Focus: Lower Saxony

Website: www.mbg-hannover.de - MBG Rheinland-Pfalz (Rhineland-Palatinate)

Stage: Startup foundation, growth, succession, SMEs

Ticket Size: Up to €1.5 million

Industry Focus: Industry-agnostic

Geographical Focus: Rhineland-Palatinate

Website: www.bb-rlp.de - KBG Saarland (Saarland)

Stage: Growth, succession, investments

Ticket Size: Individual

Industry Focus: Industry-agnostic

Geographical Focus: Saarland

Website: www.sikb.de - MBG Sachsen (Saxony)

Stage: Financing for small and medium-sized businesses

Ticket Size: Individual

Industry Focus: Industry-agnostic

Geographical Focus: Saxony

Website: www.mbg-sachsen.de - MBG Sachsen-Anhalt (Saxony-Anhalt)

Stage: Equity investments for mid-sized companies

Ticket Size: Individual

Industry Focus: Industry-agnostic

Geographical Focus: Saxony-Anhalt

Website: www.mbg-sachsen-anhalt.de - MBG Thüringen (Thuringia)

Stage: Support through silent and open participations

Ticket Size: Individual

Industry Focus: Industry-agnostic

Geographical Focus: Thuringia

Website: www.mbg-thueringen.de

- MBG Baden-Württemberg (Baden-Württemberg)

Conclusion on state-backed venture capital investors

State-backed venture capital firms are sometimes overlooked by founders, yet they can be a valuable funding source for German startups. They not only provide consistent capital—even during economically uncertain times—but also act as co-investors, facilitating access to private venture capital.

For regional startups in particular, these investors offer significant opportunities by specifically supporting local businesses. Despite occasionally bureaucratic processes, they serve as a viable alternative or complement to purely private VCs. The list above provides founders with a clear overview of the most important state-backed investors, making it easier to connect with the right funding partners.