Capvisory Insights

The perfect moment for fundraising:

What are the best months to raise capital for your startup?

At Capvisory, we support ambitious startups with their Seed and Series A funding rounds. In this article, we share insights from our hands-on experience.

Founding Partner

Founding Partner

The question of the optimal timing for fundraising is a common concern for founders. Among experts, there are two competing views on whether timing should be an integral part of a fundraising strategy.

Some experts emphasize seasonal fluctuations in the venture capital market, while others argue that the time of year has no impact on the likelihood of closing a deal.

Perspective One: Seasonality Impacts Fundraising

Anyone who has been in venture capital for a while is familiar with this saying or something similar: “Don’t raise capital in August – the VCs are on vacation.”

Analyses based on PitchBook data confirm that a significant number of financings are closed or made public in certain months—particularly January, March, June, and October.

In contrast, there is noticeably less activity in July, August, and December, with holidays and vacation times cited as the main reasons. From our own experience, we can indeed confirm that investors and key decision-makers from strategists are harder to reach during these months.

Venture capital investor Mark Suster (Upfront Ventures) shares this view, stating that VC financings are subject to seasonality:

It is very difficult to raise venture capital between November 15 — January 7th. It is also very hard to raise VC from July 15 — September 7th.

For those who subscribe to this view, it’s important to remember that every “closing” is typically preceded by weeks or even months of investor outreach and negotiation. Proponents of this theory argue that it’s less about focusing on the months when deals are closed and more about considering the months leading up to these closings. A sound strategy would be to start engaging investors 3-9 months prior (depending on market conditions, industry, and startup traction) to align with the months when closing activity is highest.

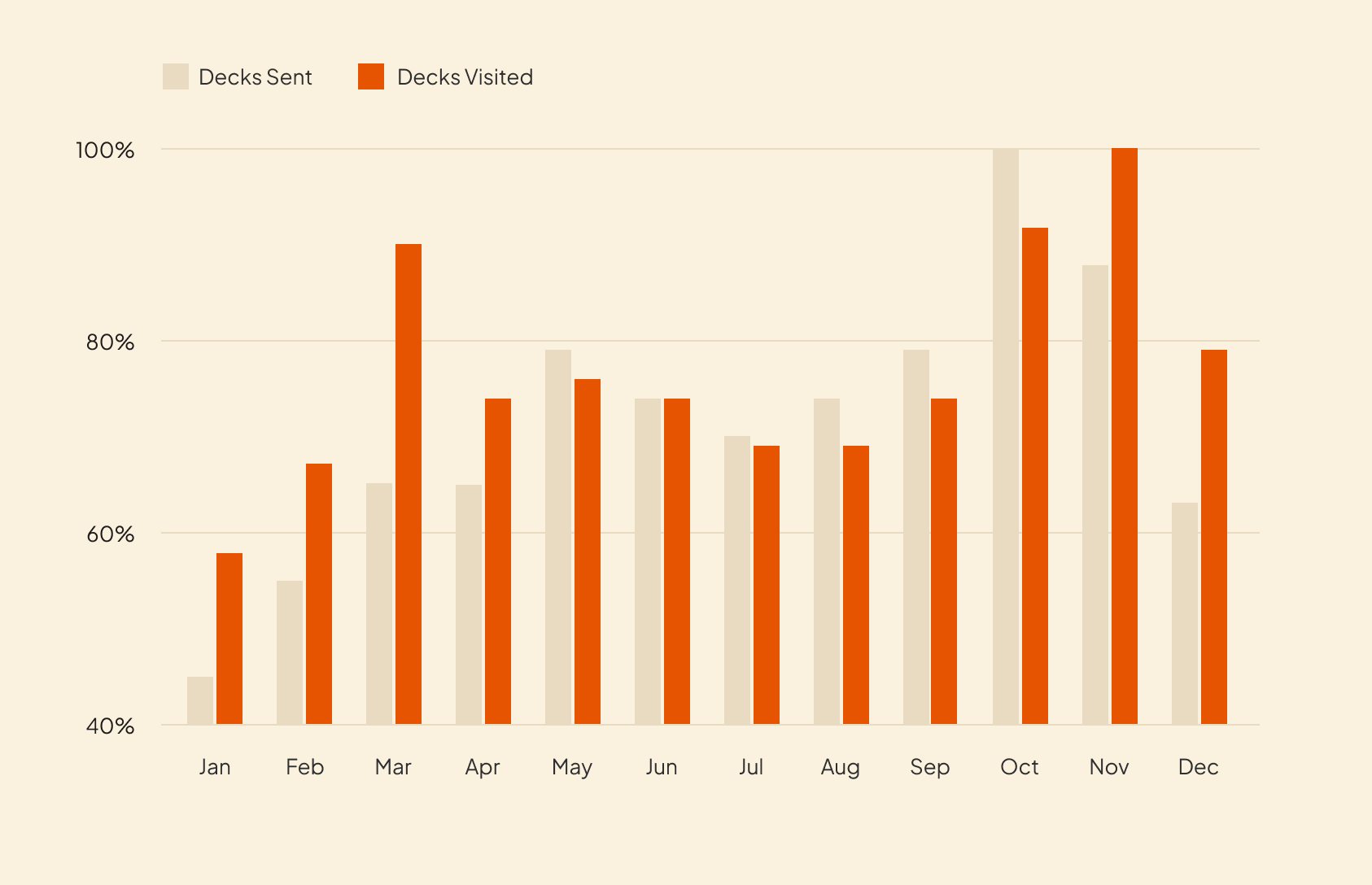

But in which months does most investor outreach take place? A 2019 analysis by DocSend, based on data from over 20,000 founders and VCs, provides valuable insights into the timing of investor outreach. According to the analysis, most founders send out their pitch decks in October, followed by November and May. VCs, on the other hand, review pitch decks most intensively in March, October, and November.

Decks Sent & Deck Visits (Studie 2019)

Another intriguing finding from the study: Pitch decks sent out in January and February receive an average of five to seven views, while this number drops to about three to five views per deck for the rest of the year.

Second Perspective: No “Perfect” Season for Fundraising

The other perspective in the market is that, despite seasonal trends, fundraising is possible year-round, and the calendar month should not be part of the fundraising strategy. For example, historical deal distribution data from Carta shows that financing activity remains relatively steady throughout the year. While June and August, often considered vacation months, show a slight dip in deal activity, they are still solid months for closings. The data from the previously mentioned DocSend study supports this view.

According to this perspective, the readiness and condition of the startup are far more important than the calendar month. Once a company can demonstrate solid growth and has built the necessary traction, the fundraising process should not be artificially delayed. The key is to approach investors when the startup has a compelling growth story and clear future prospects—and this can certainly happen in July or August as well.

Venture capital investor Fred Wilson (Union Square Ventures) supports this view, emphasizing that it’s the state of the company, not the timing, that matters.

If your company will be running out of money at or before year end, you should be raising money now. Do not let anyone convince you to wait until “everyone is back from the beach in September.” That is too late. Do it now.

The fact is: funding rounds are closed even in the height of summer. For example, in August 2024, Berlin-based startup Caresyntax announced its $180 million Series C funding round.

Our advice:

Start fundraising as soon as your startup is ready, and don’t hesitate to approach investors when you have a strong growth story to tell or when you anticipate a need for capital. From the start of fundraising to the actual disbursement of funds, it’s prudent to plan for a timeline of 6 to 9 months. A well-timed approach can help, but it’s not the sole determinant of success.

If you’re not under time pressure and can strategically choose when to start fundraising, here are the three key tips:

- Avoid the Q4 Fundraising Trap: The end of the year often follows a recurring pattern in fundraising. Activity spikes initially but then sharply declines in December. If you don’t close your round by the end of November, you risk losing momentum over the holiday period.

- Leverage VC Activity Peaks to Your Advantage: October, November, and March are the busiest months for VCs reviewing pitch decks. Try to stay ahead of the wave of applicants instead of trailing behind.

- Go Against the Grain in January & February: There’s less competition for VC attention during these months, giving you the opportunity to stand out and potentially receive increased focus from investors.