Capvisory Insights

Trends in Private Equity

Current trends in private equity fundraising (2025)

Capvisory is an independent, founder-led advisory boutique specializing in fundraising, sell-side M&A, and buy-side M&A for fast-growing tech companies and their investors.

Founding Partner

Founding Partner

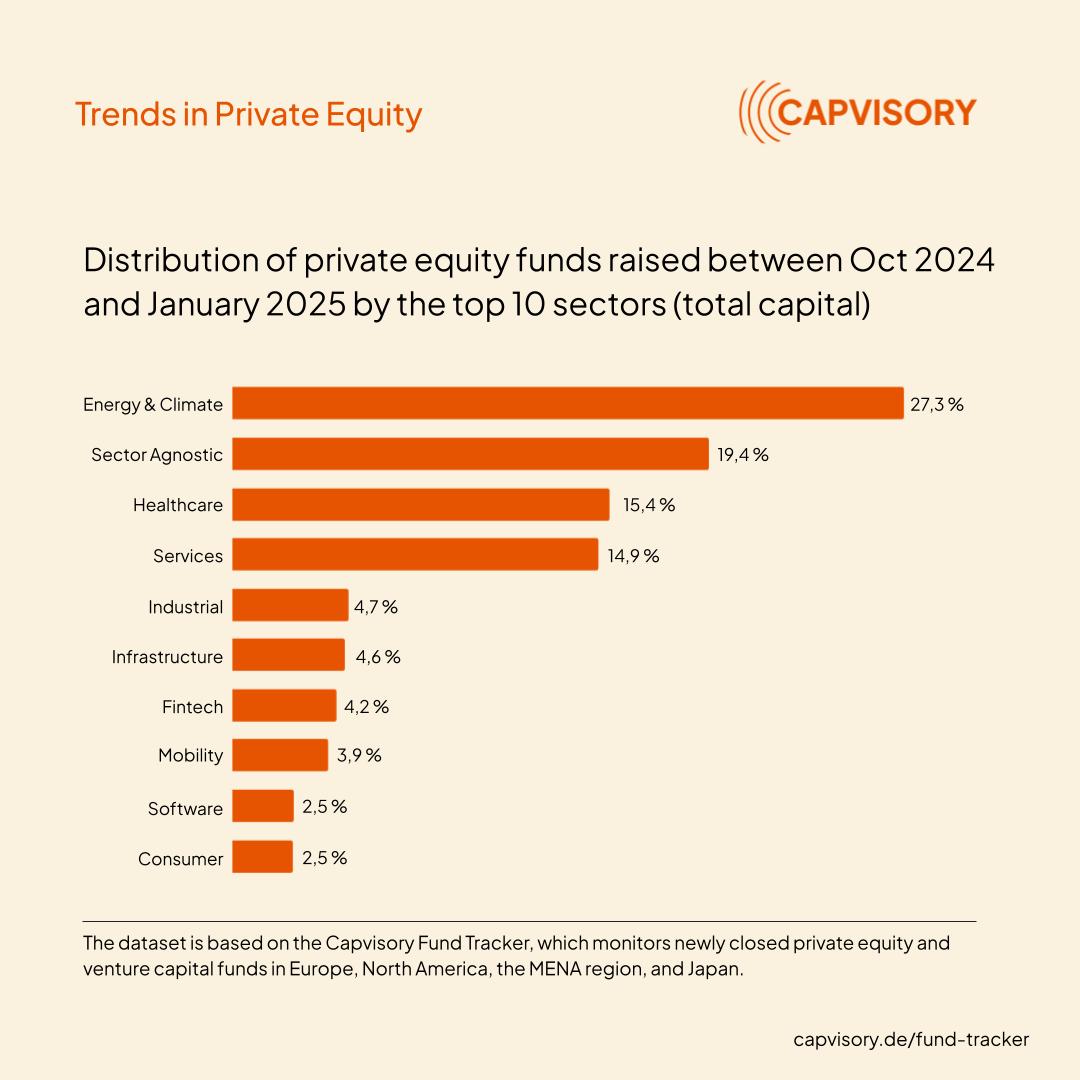

We analyzed the results of the Capvisory Private Equity Fund Tracker from October 2024 to January 2025 (4 months) and outline below how the raised capital is allocated across regions and industries.

Private Equity Remains U.S.-Dominated

Since October, we have tracked 55 new private equity (PE) funds with a combined volume of $114.9 billion. Of these, 44 funds originate from the U.S. (83,5 %), reflecting a dominance that is evident not only in the number of funds but also in the assets under management.

Particularly concerning: In Germany, only a single new private equity fund was identified during the same period: the NORD Holding UBG, with the first closing of its buyout fund DMH III at €500 million.

The regions included in our analysis are the U.S., Canada, Europe, and the MENA region.

Why Does This Matter for Entrepreneurs?

1. Impact on Startups

For ambitious tech entrepreneurs, the U.S.’s dominance in private equity means that most scaling and exit opportunities lie across the Atlantic. While American funds do invest in Europe—Thoma Bravo’s acquisition of EQS Group in early 2024 is a notable example—the U.S. remains the primary market. This explains why many world-class founders, innovative companies, and even German DAX corporations are increasingly focusing on the U.S. to benefit from its superior business and financing environment.

2. Investor Perspective

The U.S. not only boasts a high concentration of top talent and a strong entrepreneurial culture but also an immense accumulation of capital. This is already evident in public markets, where 74% of the MSCI World Index is made up of U.S. stocks (as of February 2025). A similar trend can be seen in private markets – U.S. private equity funds seem further strengthen their dominance, potentially sidelining other regions.

3. Macro-Economic Implications for Europe

While Europe has a strong industrial backbone and a resilient mid-sized business sector, it often lacks flexible capital for growth financing, restructurings, and innovation. Without a competitive private equity sector, the EU risks falling further behind economically and technologically, while other regions continue to grow faster and innovate more aggressively.

Energy & Climate Tech Leads in Funding

Between October 2024 and January 2025, private equity funds in Energy & Climate Tech attracted the highest level of investment, followed by broad, sector-agnostic funds. Healthcare and services also remained key investment areas, while traditional industries and consumer-focused sectors saw comparatively less interest.

Since private equity investors will need to deploy the capital they have raised, this trend serves as a strong signal for founders – highlighting the sectors where entrepreneurial opportunities are currently most attractive.

Conclusion

Private equity remains heavily concentrated in U.S.-based funds. Among sectors, Energy & Climate Tech stood out as the most attractive to private equity investors between October 2024 and January 2025.

With our Capvisory Fund Tracker, we will continue monitoring new private equity and venture capital funds and providing regular updates. To get the latest insights directly in your LinkedIn feed, follow Julius Krätschmer on LinkedIn.