Capvisory Insights

Understanding the stages of startup funding

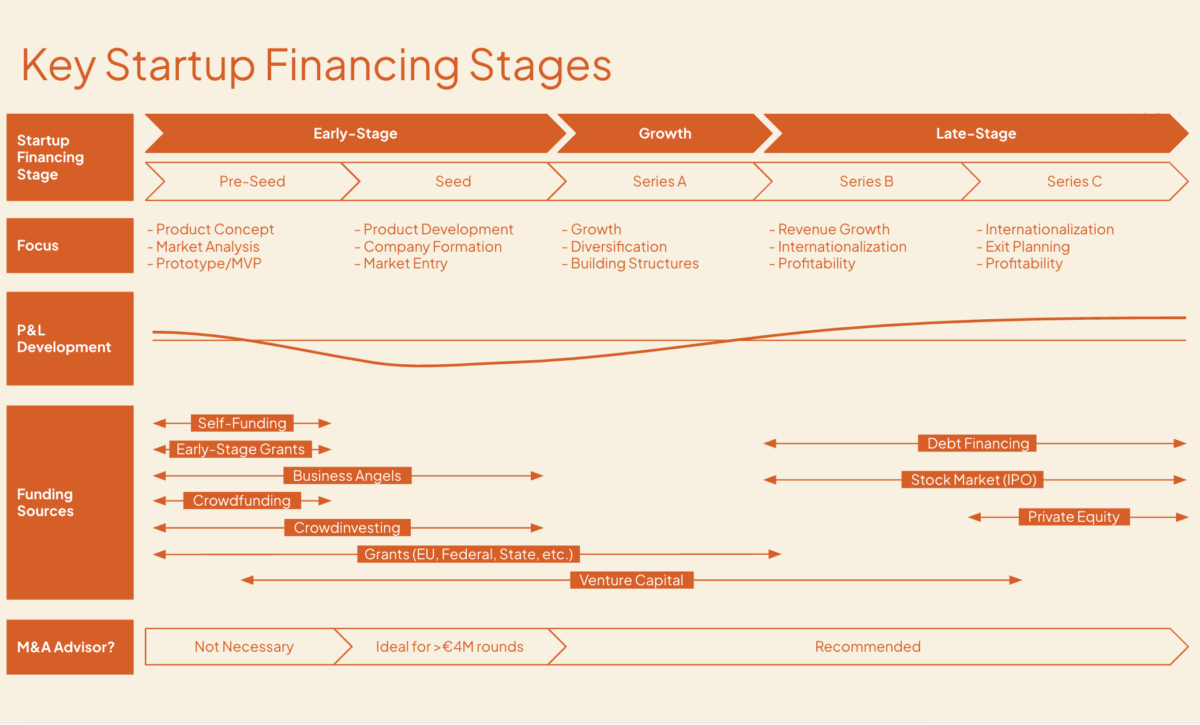

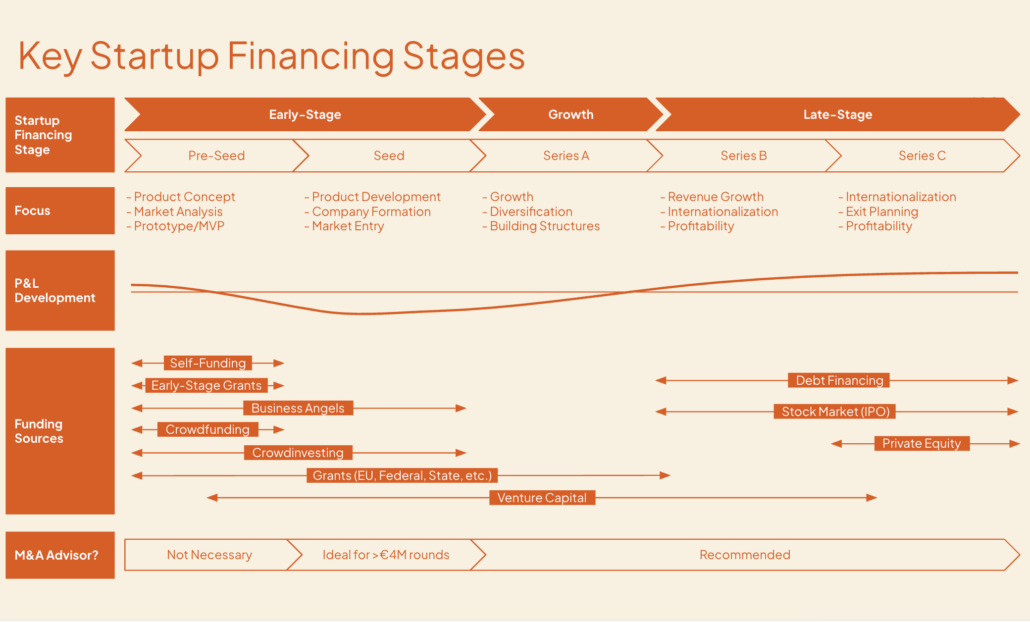

Key startup financing stages and benchmarks (2025)

The specialized Berlin-based M&A boutique Capvisory supports startups in Seed and Series A funding rounds as well as in exit processes. In this content piece, we provide an overview of key startup financing stages and benchmarks for 2025.

Founding Partner

Founding Partner

This brief overview is designed for newcomers to the startup ecosystem who want to get up to speed quickly. It not only explains the individual funding stages but also provides concrete benchmarks, such as valuations, dilution, and growth metrics. Additionally, we offer a concise perspective on when (in our view) it makes sense to collaborate with fundraising or M&A boutiques.

Note: The stages are intended as a general guideline for all participants in the ecosystem to more easily gauge a startup’s progress. However, every startup journey is unique and may not necessarily fit into these standardized frameworks. Benchmarks vary depending on industry, country, and economic conditions, and should therefore only be viewed as a rough guideline.

1. Pre-Seed Phase: The Concept Phase

The pre-seed phase marks the starting point of a startup’s journey. The primary goal is to identify a clear problem and define an innovative solution.

This phase demands significant initiative from the founders, as it is often self-funded. However, founders with an attractive track record or a particularly innovative idea may attract professional investors willing to finance this phase based solely on the team, the idea, and a pitch deck. Examples include Berlin-based investor seed + speed or Munich-based Picus Capital. No revenues are typically expected at this stage.

- Focus: Ideation, market research, founding team, prototype (MVP) development

- Funding: Self-funding, grants, accelerator programs (e.g., Reaktor), crowdfunding, family offices, business angels, or specialized pre-seed VCs

- Valuation: €1M–€5M

- Investment Ask: €0.3M–€2M

- Dilution: 5%–15%

- Team Size: 1–5 employees

- Metrics: Typically not relevant yet

- Should you work with a fundraising advisor? At this stage, we believe it makes sense for founders to handle fundraising themselves. This helps build a vital network, gather feedback on their idea, and gain initial experience with the fundraising process for later stages.

- Risk: High risk for investors. Over 90% of startups fail after this phase.

2. Seed Phase: Testing Market Response

In the seed phase, the startup refines its concept and takes its first steps toward market entry. The goal is to validate product-market fit (PMF) and acquire initial paying customers, laying the foundation for further growth.

- Focus: Company formation, product development, market entry, acquiring initial customers, and ensuring high customer satisfaction

- Funding: Business angels, crowd investing, early-stage venture capital funds (e.g., Cherry Ventures), grants, family offices, strategic investors

- Valuation: €5M–€15M

- Investment Ask: €1M–€5M

- Dilution: 15%–20%

- Team Size: 5–30 employees

- Metrics: Revenue of €0–€2M, MoM growth >10%, high retention rate, and efficient customer acquisition costs (CAC)

- Should you work with a fundraising advisor? Depending on the size and complexity of the round and your growth objectives, involving an advisor—at least in a consulting role—can be worthwhile. At Capvisory, we typically invest 300–400 hours per mandate in this phase, freeing up founders to focus on sales, product development, and hiring (a clear ROI).

- Risk: Still a very high risk for investors. Approximately 75% of startups fail after this phase.

3. Series A: The Growth Phase

The Series A financing round marks the startup’s transition into the growth phase. The focus is on scaling operational processes and achieving substantial revenue growth. Startups often aim to increase market share and expand their existing customer base. This phase usually makes the startup more visible within its industry, as it positions itself as a new player in the market.

- Focus: Growth, diversification, hiring, and building organizational structures

- Funding: Venture capital funds (e.g., Project A), family offices, venture debt, or strategic investors (e.g., established companies in the same sector)

- Valuation: €15M–€100M

- Investment Ask: €5M–€30M

- Dilution: 15%–25%

- Team Size: 30–75 employees

- Metrics: Revenue of €0.5M–€10M, YoY revenue growth >50%

- Should you work with a fundraising advisor? Fundraising advisors can provide significant value at this stage by driving the process alongside founders at an operational level. Founders benefit from advisors’ expertise, investor networks, and operational support, saving countless hours of time. At this stage, Capvisory invests an average of 600+ hours per mandate, allowing founders to focus on sales, product development, and hiring—a clear ROI.

“Advisors can add a lot of value when raising a round of capital, particularly at the later stages. Such advisors can help streamline the process by front-loading a lot of the diligence and preparation, allowing you to focus more closely on running the company.”

— Steve McDermid, Former Partner at Andreessen Horowitz

- Risk: There are currently no reliable studies on failure rates for European startups after each funding stage. However, it is estimated that approximately one-third of startups fail after Series A. The definition of “failure” remains subjective, as even uneconomical exits are often presented as successes. From our perspective, the actual failure rate from an investor’s standpoint is likely even higher—particularly during the 2022–2024 period.

4. Series B: Scaling and Market Penetration

The Series B phase signifies the transition from product-market fit to aggressive scaling. Companies in this phase aim to achieve market dominance in their segment and lay the foundation for international expansion. Revenue growth and efficiency improvements are driven by expanding sales, marketing, and operational structures.

Professional management, well-established processes, and strong KPIs become increasingly critical to attract investors.

- Focus: Market leadership in existing markets, expansion into new regions or industries (organically or via M&A), preparation for an exit (IPO, trade sale), or achieving sustainable profitability

- Funding: Late-stage VCs, private equity investors, strategic partners, and debt financing

- Valuation: Over €100M, often between €200M–€1B

- Investment Ask: €10M–€200M, depending on expansion and M&A plans

- Dilution: 5%–20%, depending on the startup’s negotiation leverage, market conditions, and financing structure

- Team Size: 300–1,000+ employees, with highly specialized teams across departments

- Metrics: Revenue >€30M, growth rate of 1.2x–2x, burn multiple <1.5, often achieving initial or sustained profitability

- Should you work with a fundraising advisor? Yes, similar to Series A

- Risk: Low risk of total loss. The main risks stem from regulatory changes, challenges in M&A integrations, or loss of market share.

5. Series C and Beyond: Maturity Phase

The Series C phase and subsequent funding rounds are highly individualized. As startups grow in size and maturity, general benchmarks become less relevant due to variations in industry, business models, and strategic goals.

Companies at this stage have an established market presence, significant revenues, and often pursue strategic objectives such as market dominance, M&A transactions, or an IPO.

- Focus: Market leadership in existing markets, expansion into new regions or industries (organically or via M&A), preparation for an exit (IPO, trade sale), or achieving sustainable profitability

- Funding: Growth funds, private equity investors, strategic partners, debt financing, or public markets (IPO)

- Valuation: Over €180M, often between €200M–€3B

- Investment Ask: €10M–€200M, depending on expansion and M&A plans

- Dilution: 5%–20%, depending on negotiation leverage, market conditions, and financing structure

- Team Size: 300–1,000+ employees, often with highly specialized teams across departments

- Metrics: Revenue >€50M, growth rate of 1.2x–2x

- Should you work with a fundraising advisor? Yes, similar to Series A

- Risk: Low risk of total loss

Focus section: At what stage does it make sense for startups to engage M&A advisors?

At Capvisory, we operate as M&A advisors, so we cannot answer this question entirely objectively. However, many experienced entrepreneurs would agree that starting from Series A and beyond, there are compelling arguments for working with an M&A advisor:

- Access to a broader investor network: M&A advisors have extensive networks and can connect startups with investors they might not reach on their own. Especially in Series A rounds, a strategically diverse investor process is critical.

- Process optimization: Preparing pitch decks, financial models, and due diligence materials is highly time-consuming. An M&A advisor handles many of these tasks, allowing the founding team to focus on core business operations.

- Negotiation expertise: Negotiating valuation metrics, term sheets, and investor agreements can be complex. Advisors bring the experience needed to secure better terms and avoid potential pitfalls.

- Market expertise: M&A advisors understand current market dynamics and trends. They can help position the company optimally or identify alternative financing options.

Conclusion: Startup Funding Stages

Defining distinct funding stages with clear terms provides a general framework for orientation and improves communication among all stakeholders. Each stage demands tailored financing strategies and operational approaches. A solid understanding of the specific phase a startup is in helps streamline communication with stakeholders, particularly with potential investors.

Founders should regularly evaluate their funding needs and strategic priorities to ensure sustainable growth and long-term success.