Capvisory Fund Tracker - Dry Powder Series November 2025

$6.45 billion in fresh venture capital and $46.28 billion in private equity raised for founders

Capvisory is a Berlin-based M&A boutique supporting tech founders in raising Seed to Series B funding and navigating successful exits.

Founding Partner

Founding Partner

Each month, we track newly closed venture capital and private equity funds that empower startups on their growth journey. We aim to create the most comprehensive and reliable venture capital fund tracker, tailored to founders and entrepreneurs seeking insights into funds with significant investment capacity.

We focus on funds from Europe, the United States, Canada, Japan and the MENA region. We only feature funds that have successfully completed at least a first closing to ensure they actually have dry powder to invest.

Summary and insights of November 2025

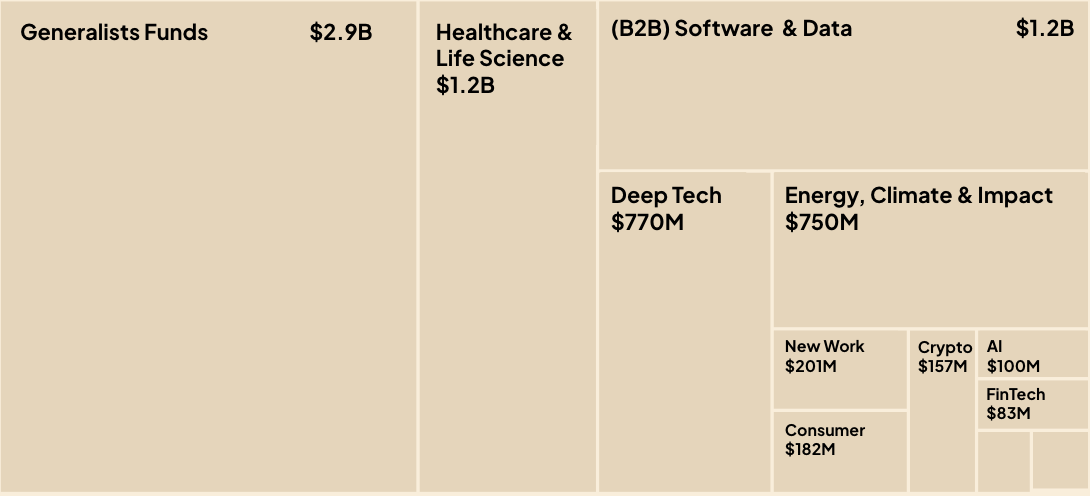

In November 2025, we recorded 49 new venture capital fund closings, totaling $6.46 billion

$179M VC Fund: Invests €1M to €5M in enterprise software, AI, and fintech at seed and Series A.

undisclosed VC Fund: Targets advanced stage HealthTech and digital health companies

$130M (First Close) VC Fund: Early stage investments in disruptive technologies including AI, cybersecurity, and digital infrastructure.

$100M VC Fund: Seed investor backing European deep tech, AI, and frontier technology founders.

$81M (First Close) $100M (Target) VC Fund: Invests in early stage frontier and dual use technologies across the Baltic Sea region.

$15M VC Fund: Invests $300k to $350k in pre seed and seed startups in AI, robotics, and defence.

$1B VC Fund: Invests in ethical emerging technologies including AI, blockchain and digital infrastructure.

$17.3M VC Fund: Invests in African founders building mass market tech enabled solutions across Sub Saharan Africa.

$34.8M VC Fund: Invests in early stage worktech and edtech across Europe and the US.

$136M VC Fund: Invests in crypto infrastructure, early stage blockchain, and DeFi.

$23M VC Fund: Generalist investor writing ~$500k checks at the first institutional round.

$300M VC Fund: Invests in AI, deep tech, crypto, and high ambition founders.

$70M (First Close) $250M (Target) VC Fund: Invests globally in quantum computing, sensing, communications, and related applications.

$11M (First Close) $30M (Target) VC Fund: Invests in pre seed and seed startups in financial inclusion, digital finance, and infrastructure.

$232M VC Fund: Invests in early and growth stage bioeconomy, biomanufacturing, and biotech across food, agriculture, materials, and environmental tech.

$237.8M VC Fund: Invests in digital and asset light energytech including grid optimisation, storage, and renewables.

$200M VC Fund: Pre seed and seed investor in AI native and frontier enterprise technologies.

$78.38M (First Close) $105M (Target) VC Fund: Invests in early stage B2B software and unconventional European founders.

$24.36M VC Fund: Day zero investor backing Nordic AI and B2B software founders.

$35M (First Close) $145M (Target) VC Fund: Invests in Southern European deeptech, SaaS, marketplaces, AI, spacetech, fintech, cybersecurity, and ocean tech.

$250M VC Fund: Invests in early stage dual use and frontier technology companies.

$174M VC Fund: Invests in defence and security technologies across NATO aligned countries.

$580M VC Fund: Life sciences investor backing innovative biotech companies with clear product visions to transform patient care.

$70M VC Fund: Backs Israeli founders across enterprise software, AI, cybersecurity, fintech, digital health, climate tech, and robotics.

$125M VC Fund: Invests in early stage technical founders in AI, hardware, and software with a hands on model.

$80M VC Fund: Seed stage investor backing global enterprise software and vertical AI founders.

$116M VC Fund: Backs European food innovation founders building scalable, defensible consumer and food tech companies.

undisclosed VC Fund: CPG focused fund pairing media distribution with venture capital to scale consumer brands faster.

$4.3M VC Fund: Backs community driven pre seed and seed startups with $100k to $250k checks.

$300M VC Fund: Invests in disruptive technology startups and breakthrough life sciences ventures at Seed stage.

undisclosed VC Fund: Backs B2B software, fintech, and insurtech companies at growth and late stage in the US and Israel with AI driven business models.

$25M VC Fund: Pre seed investor providing first institutional checks to Israeli founders in AI infrastructure, agents, media, and lifestyle for enterprise and consumer.

$190M VC Fund: Deep tech seed investor leading $2M to $3M rounds for technical founders.

$76M VC Fund: Third impact fund backing European climate tech, circularity, and social inclusion startups.

$75M (First Close) $93M (Target) VC Fund: Backs European social impact ventures in climate, inclusion, and health.

$750M VC Fund: Capital XI fund investing in early stage healthcare, therapeutics, and biotech innovation.

$33M (First Close) $54M (Target) VC Fund: Seed fund dedicated to Italian digital and AI startups with global scale potential.

$23M VC Fund: Invests in climate and health deeptech with athlete backed founder support.

$110M VC Fund: Fund II investing in early stage legaltech, AI enabled workflows, and next generation legal infrastructure.

$93M VC Fund: Invests in cybersecurity and advanced security technologies across Europe.

undisclosed VC Fund: Corporate venture arm investing in early and growth stage worktech startups.

$54.5M (First Close) $88M (Target) VC Fund: Backs underrepresented European founders across sectors such as climate sustainability, health, and education.

$35M VC Fund: Pre seed and seed fund supporting European deeptech and emerging technology startups with a target size of $80M.

$93M VC Fund: Fund IV investing in early stage B2B SaaS startups across the Nordics and Baltics with a focus on AI first SaaS.

$64M (First Close) $75M (Target) VC Fund: Seed and early Series A pan African fund focused on fintech, healthtech, AI, and other tech driven solutions.

$200M VC Fund: Debut fund targeting emerging tech companies from seed to Series A.

$232M (First Close) VC Fund: Backs European startups across AI transformation, deep tech, and sustainable future themes.

$11.6M VC Fund: Backs founders under 26 in Germany with first checks between $50k and $100k, sector agnostic.

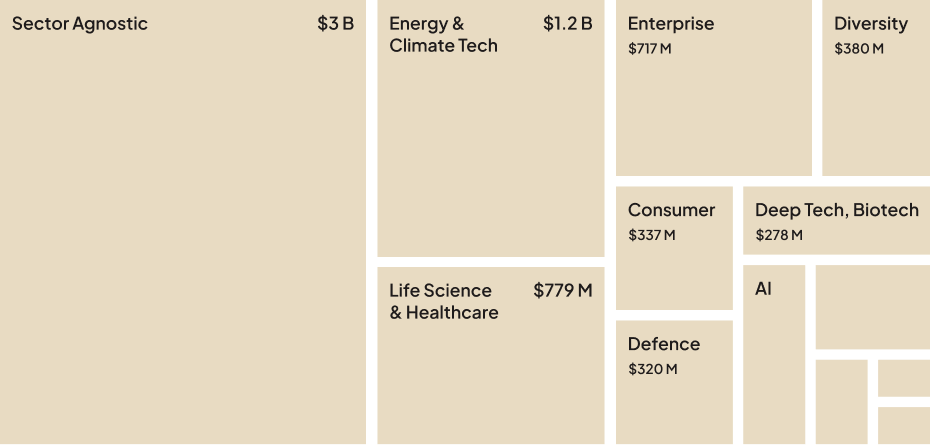

In October 2025, we also counted 29 new private equity fund closings totaling $46.28 billion

$278M PE Fund: Dutch lower mid market buyout fund backing founder and management owned companies in defensible niches in the Netherlands.

$290M PE Fund: Pan European infrastructure manager backing essential infrastructure projects across continental Europe, the UK, and Ireland.

$6B PE Fund: Fourth flagship fund targeting technology led industrial businesses in defense, aerospace, life sciences, energy transition, and specialty materials.

$950M PE Fund: Growth buyout fund focused on European financial and enterprise technology services platforms.

$532.44M PE Fund: Lower mid market Elevate fund investing across Nordic technology, business services, and healthcare.

$725M PE Fund: Invests in mid market companies in the Netherlands, Belgium, and Germany with operating results up to €50M.

$1B PE Fund: Backs durable growth stage software companies with operational support.

$505M (First Close) $1B (Target) PE Fund: Invests in foodservice, franchising, and multi unit business models leveraging 20 years of operational expertise.

$500M PE Fund: Invests in catalogs, record labels, and music driven ventures focused on sustainable long term value and artist centered growth.

$580M PE Fund: Invests in specialised international and Nordic small and mid cap buyout funds plus select co investments.

$11.7B PE Fund: Global digital infrastructure fund investing in data centers, fiber networks, edge infrastructure, and towers.

$433M PE Fund: Third buyout fund supporting French SMEs and mid caps through growth, transformation, and special situations.

$67M PE Fund: Growth debt fund backing VC sponsored post Series A tech companies with $3M+ revenue and strong PMF.

$1B PE Fund: Co investment Fund II focused on small and mid market buyouts.

$375M PE Fund: Natural climate solutions strategy investing in land restoration, ecosystem protection, and global carbon reduction.

$561M PE Fund: Fund IV backing high growth companies in technology and life sciences with strong management partnerships.

$430M PE Fund: Debut energy secondaries fund providing liquidity solutions across energy and energy infrastructure value chains.

$350M PE Fund: Invests in high growth consumer brands across food, beauty, pet, and services.

$388M PE Fund: Buyout investor in knowledge intensive, asset light, founder led B2B companies in the Netherlands across IT and business services, critical engineered components, and essential products.

$2.5B PE Fund: Joint buyout platform targeting succession deals and mid market corporate carve outs in Japan.

$1.2B PE Fund: Invests in energy transition, power generation, and grid scale infrastructure assets.

$189M PE Fund: Provides structured liquidity and NAV based financing for founders, venture portfolios, and PE funds.

$750M PE Fund: Offers access to diversified private market buyout and growth equity exposure via secondaries and co investments.

$1.6B PE Fund: Invests in middle market business services and distribution companies.

$350M PE Fund: Lower mid market investor specializing in corporate carve outs and complex transactions across enterprise software and tech enabled services.

$321M PE Fund: Provides growth debt and structured equity to technology companies.

$12B (First Close) $17B (Target) PE Fund: Global fund targeting growth equity and large cap buyout opportunities.

$216M (First Close) PE Fund: Backs Swiss and European growth companies in health, industry, and data services.

Did our fund tracker miss anyone in November 2025?

Let us know about any missing VCs or PEs by emailing us at hi@capvisory.de.

P.S. We’re always trying to keep track of all relevant funds to keep our internal investor CRM (tracking 20,000+ investors globally) up-to-date. This resource helps us to kickstart investor funnel creation for every fundraising and M&A project.

- VentureCapital

- PrivateEquity

- StartupFunding

- GrowthJourney

- Fundraising

- MergersAndAcquisitions

- Capvisory