Capvisory Fund Tracker - Dry Powder Series May 2025

$9.11 billion in fresh venture capital and $98.79 billion in private equity raised for founders

Capvisory is a Berlin-based M&A boutique supporting tech founders in raising Seed to Series B funding and navigating successful exits.

Founding Partner

Founding Partner

Each month, we track newly closed venture capital and private equity funds that empower startups on their growth journey. We aim to create the most comprehensive and reliable venture capital fund tracker, tailored to founders and entrepreneurs seeking insights into funds with significant investment capacity.

We focus on funds from Europe, the United States, Canada, Japan and the MENA region. We only feature funds that have successfully completed at least a first closing to ensure they actually have dry powder to invest.

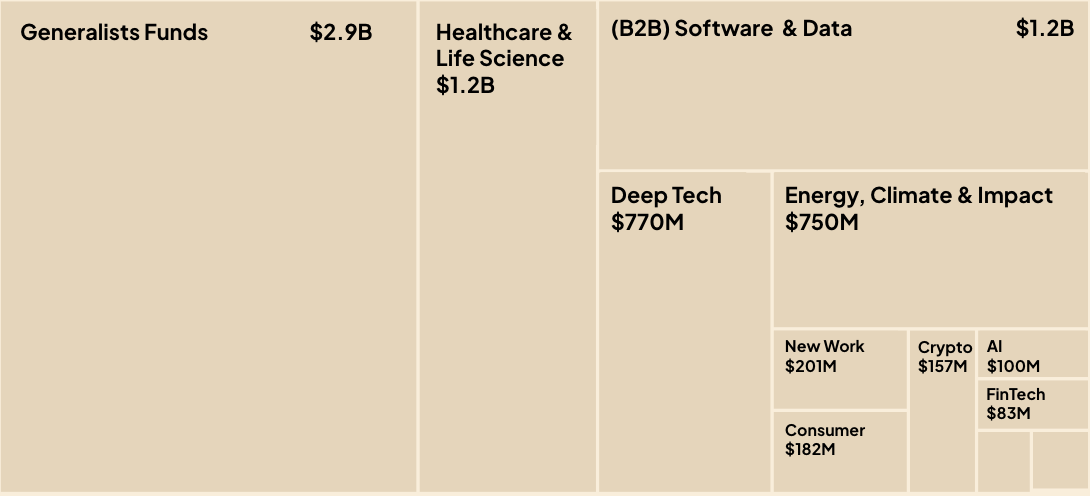

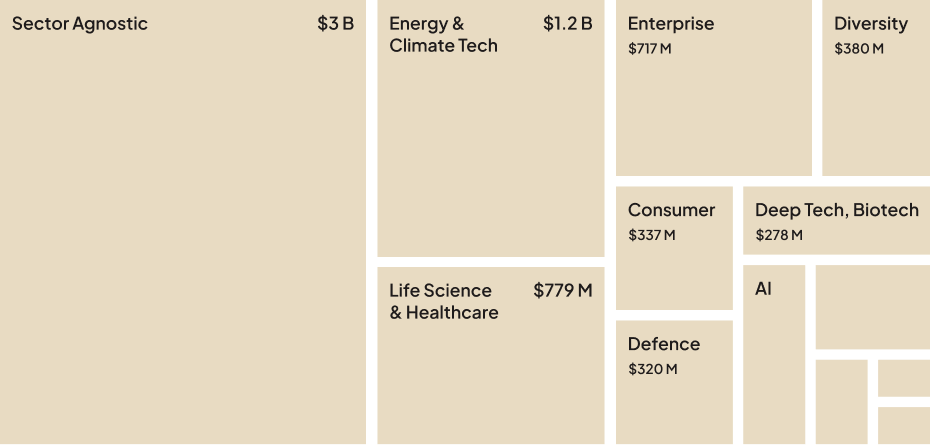

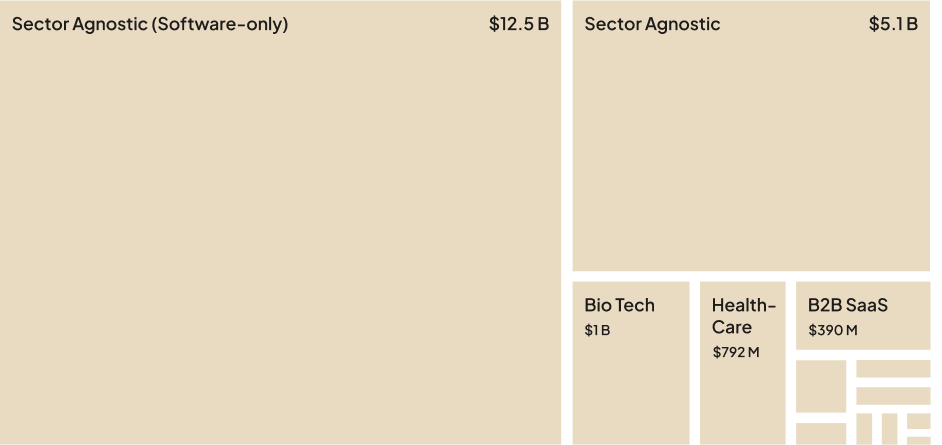

In May 2025, we recorded 65 new venture capital fund closings, totaling $9.11 billion

$5.8M VC Fund (first close): Pre-Seed fintech & SaaS in emerging hubs.

In May 2025, we also counted 26 new private equity fund closings totaling $98.79 billion

$383M PE Fund: Co-investment & secondaries in mid-market buyouts.

$740M PE Fund: Public vehicle for global healthcare & life-science growth.

Did our fund tracker miss anyone in May?

Let us know about any missing VCs or PEs by emailing us at hi@capvisory.de.

P.S. We’re always trying to keep track of all relevant funds to keep our internal investor CRM — tracking 20,000+ investors globally — up-to-date. This resource helps us to kickstart investor funnel creation for every fundraising and M&A project.

- VentureCapital

- PrivateEquity

- StartupFunding

- GrowthJourney

- Fundraising

- MergersAndAcquisitions

- Capvisory