Capvisory Fund Tracker - Dry Powder Series June 2025

$5.40 billion in fresh venture capital and $33.42 billion in private equity raised for founders

Capvisory is a Berlin-based M&A boutique supporting tech founders in raising Seed to Series B funding and navigating successful exits.

Founding Partner

Founding Partner

Each month, we track newly closed venture capital and private equity funds that empower startups on their growth journey. We aim to create the most comprehensive and reliable venture capital fund tracker, tailored to founders and entrepreneurs seeking insights into funds with significant investment capacity.

We focus on funds from Europe, the United States, Canada, Japan and the MENA region. We only feature funds that have successfully completed at least a first closing to ensure they actually have dry powder to invest.

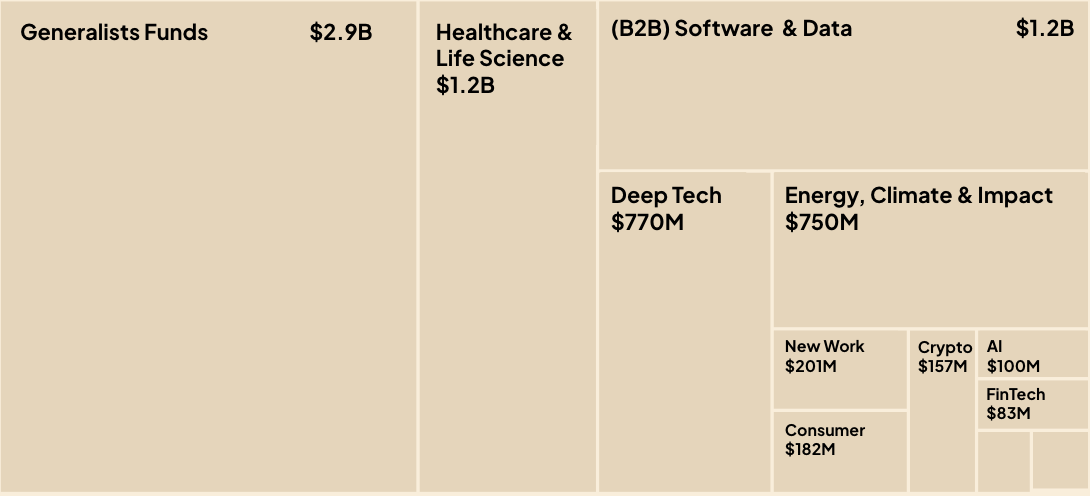

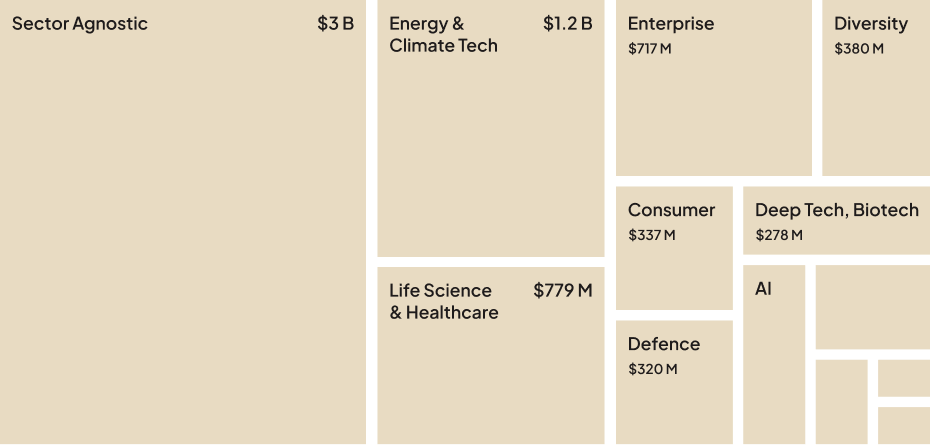

In June 2025, we recorded 47 new venture capital fund closings, totaling $5.40 billion

undisclosed (First Close), $11M (Target) VC Fund: Seed-stage investments in startups developing Type-1-Diabetes healthtech solutions.

Accelerator: Canadian innovation hub supporting deep-tech founders.

$900M VC Fund: Backing technical founders building tools for devs, data teams & ML engineers.

$5.8M (First Close), $11,4M (Target) VC Fund: Early-stage biotech across Europe & beyond.

$15.7M VC Fund: Backing early-stage ventures in Europe & US across marketplaces, consumer platforms & consumerised SaaS.

$75M VC Fund: For improving economic mobility, healthcare access & resilient community infrastructure.

$100M (Target) VC Fund: Robotics & automation for industrial transformation.

$41M VC Fund: Co-building deep-tech startups to bring government-grade cybersecurity innovation to market.

$20M VC Fund: Seed-stage US fund focused on founder DNA and operator-driven ventures.

$900M VC Fund: Multi-stage fund for AI, healthtech & frontier innovation globally.

$105M CVC Fund: Strategic bets in enterprise IT & digital transformation.

$300M (est.) VC Fund: Life‑sciences venture fund backing Canadian medtech & biotech innovation.

$34.5M (First Close), $115M (Target) VC Fund: Early-stage across the Baltics.

undisclosed (First Close), $40M (Target) VC Fund: Fintech from Seed to Series B.

$30M (First Close), $100M (Target) VC Fund: Equity & credit bets in regulated-market tech.

$25M VC Fund: Midwest tech and social impact innovation.

$46M (First Close), $92M (Target) VC Fund: Agri & food-tech innovation across the Nordics.

$68.4M VC Fund: Spinouts from UK northern universities.

$80.5M (First Close), $115M (Target) Debt Fund: Growth debt for underbanked tech firms.

$34.5M (First Close), $115M (Target) VC Fund: Quantum-tech commercialization.

$12.7M (First Close), $34.5M (Target) Fund: Early growth capital for European tech scale-ups.

undisclosed VC Fund: Gen-Z brands at the intersection of culture, creators & community.

undisclosed VC Fund: Investing in disruptive technologies across defense, energy & dual-use.

$30M (First Close), $60M (Target) VC Fund: Midwest-focused early-stage startups.

$115M VC Fund: Family office backing European tech founders long-term from seed to growth.

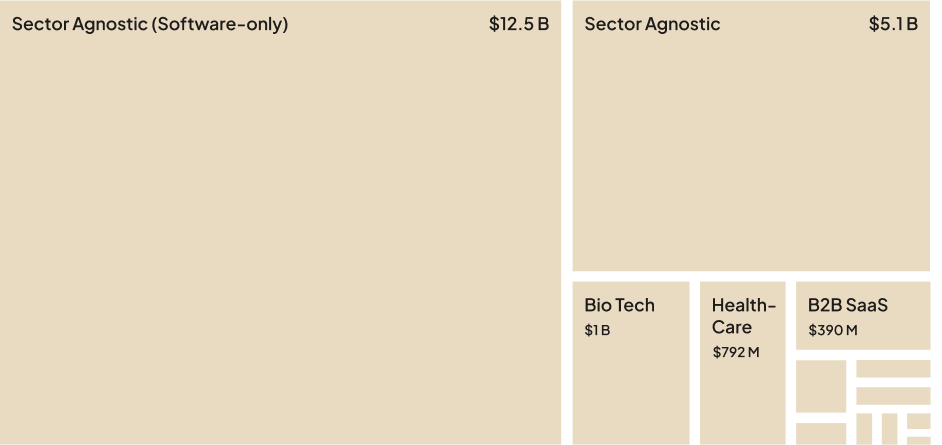

In June 2025, we also counted 20 new private equity fund closings totaling $33.42 billion

$4.0B PE Fund: Debut flagship vehicle focusing on US private equity buyouts, credit & insurance.

$2.4B PE Fund: Inaugural vehicle for hyperscale data center development in Japan.

$4.8B PE Fund (Target): Defense, aerospace and government services buyouts.

$1.0B PE Fund: Control buyouts across US lower-mid-market sectors.

$38.5M PE Fund: SME succession & growth investments in Germany.

$5.0B (Target) PE Fund: Tech, healthcare & consumer growth equity strategy.

$3.2B PE Fund: Flagship for mid-market buyouts across healthcare, industrials & services.

$1.0B PE Fund: Energy investments in upstream & midstream sectors.

$86.3M (First Close), $172.5M (Target) PE Fund: Software growth capital across Europe.

$150M (Target) PE Fund: Secondary growth-equity fund acquiring stakes from VCs and late-stage operators.

Did our fund tracker miss anyone in June?

Let us know about any missing VCs or PEs by emailing us at hi@capvisory.de.

P.S. We’re always trying to keep track of all relevant funds to keep our internal investor CRM — tracking 20,000+ investors globally — up-to-date. This resource helps us to kickstart investor funnel creation for every fundraising and M&A project.

- VentureCapital

- PrivateEquity

- StartupFunding

- GrowthJourney

- Fundraising

- MergersAndAcquisitions

- Capvisory