Capvisory Fund Tracker - Dry Powder Series February 2025

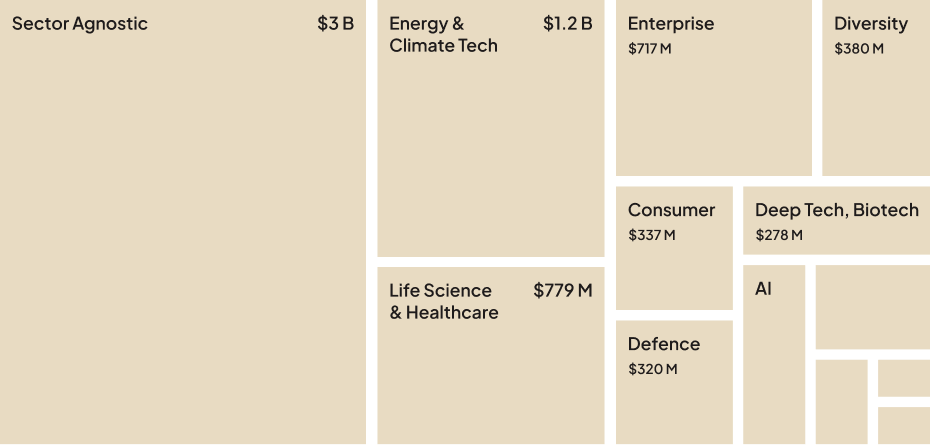

$7.67 billion in fresh venture capital and $17.83 billion in private equity raised for founders

Capvisory is an advisory boutique specializing in fundraising, sell-side M&A, and buy-side M&A for fast-growing tech companies and their investors. Each month, we monitor and highlight newly announced venture capital and private equity fund closings.

Founding Partner

Founding Partner

Each month, we track newly closed venture capital and private equity funds that empower startups on their growth journey. We aim to create the most comprehensive and reliable venture capital fund tracker, tailored to founders and entrepreneurs seeking insights into funds with significant investment capacity.

We focus on funds from Europe, the United States, Canada, Japan and the MENA region. We only feature funds that have successfully completed at least a first closing to ensure they actually have dry powder to invest.

In February 2025, we recorded 46 new venture capital fund closings, totaling $7.67 billion

$125M VC Fund: Invests in hard tech for tough markets, supporting early-stage founders from Europe and Israel in scaling globally.

$500M VC Fund: Sector-agnostic fund split between early-stage investments and follow-ons through Series B and beyond.

$400M VC Fund: Invests in startups with cutting-edge digital technologies, industrial AI, quantum, life sciences, and space tech.

$50M VC Fund: Invests in gaming and app startups at pre-seed and seed stages, leveraging industry expertise.

$230M VC Fund: Supports AI-native 'Software 3.0' companies, investing $1M-$10M at early stages.

$85M VC Fund: Invests at (pre)seed and seed stages in startups from France, Denmark, and Sweden.

$30M VC Fund: Pre-seed and seed-stage crypto venture firm focused on blockchain innovation.

$54M VC Fund: Invests in early-stage software companies at pre-seed, seed, and select Series A rounds, with check sizes of $500K-$1.5M.

$33M VC Fund: Focuses on early-stage investments in frontier tech, including energy, space, robotics, and semiconductors.

$615M VC Fund: Invests in high-growth companies through fund investments, direct deals, and solution-oriented secondaries.

$300M VC Fund: Invests €10M-€50M in growth buyouts and tech growth deals across France and Southern Europe.

$744M VC Fund: Focuses on climate tech and decarbonization, backed by Japanese industrial and financial institutions.

$115M VC Fund: Invests in non-listed European SMEs and scale-ups focused on the energy transition.

$8.6M VC Fund: Germany’s first alumni fund, investing in (pre)seed startups from CDTM with a network of 300+ LPs.

$150M VC Fund: Invests in early-stage tech across LegalTech, Fintech, Risk & Compliance, and Media.

$50M first closing: VC focused on healthcare transformation through technology, supporting early-stage startups.

$100M VC Fund: Nordic Fund II backs founders at inception, investing €300K in two tranches.

$208M VC Fund: Seed-stage investor with a focus on data-driven decision-making and diverse founders.

$67M VC Fund: Climate tech investor supporting the next global leaders in sustainability.

$1.6M VC Fund: Early-stage investor focusing on sustainable startups with acceleration support.

$249M VC Fund: Invests in climate tech companies from seed to Series A.

$75M VC Fund: Nordic-focused investor in life sciences and technology startups.

$30M VC Fund: Sector-agnostic VC investing in early-stage startups across MENA and U.S.-based AI.

$105M VC Fund: Focuses on consumer health innovation, shifting healthcare from reactive to proactive.

$46M first closing: Early-stage VC deploying €250K-€2M per ticket across scalable tech startups.

$6.6M VC Fund: Invests $100K-$200K at pre-seed and seed stages, aiming for 30 companies in Fund I.

$172M VC Fund: Invests in Series A & B rounds, focusing on underinvested entrepreneurs.

$400M VC Fund: Invests in early-growth enterprise technology companies.

$528M VC Fund: Invests across all stages of clinical development, focusing on high-impact biotech.

$29.5M VC Fund: Backs pre-seed startups with gender-diverse founding teams in ClimateTech, FemTech, HealthTech, FinTech, and HR Tech.

$40M VC Fund: Supports the startup ecosystem in Saarland with direct investments and fund-of-funds strategies.

$210M VC Fund: Prioritizes B2B SaaS businesses with $3M-$20M in recurring revenue, focusing on PLG and inbound models.

$126M VC Fund: Invests in the Cambridge startup ecosystem, supporting early-stage deep tech and life sciences.

$42M VC Fund: European-focused fund investing at early stages, open to Series A, with flexible initial tickets up to €1M.

$225M VC Fund: Leads and co-leads Seed and Series A rounds in consumer tech and enterprise consumerization.

$185M VC Fund: Backs product-oriented founders at pre-seed, focusing on software startups.

Funding undisclosed: VC firm connecting Silicon Valley and Southeast Asia investors, focused on climate tech, supply chain, and health tech.

$245M VC Fund: Invests exclusively in B2B software at the seed stage, making ~10 investments per year.

Funding undisclosed: Pre-seed VC fund supporting early-stage biotech startups with capital, lab space, and mentorship.

$100M VC Fund: Supports SME growth in Romania, focusing on healthcare, B2B services, retail, and niche manufacturing.

$50M VC Fund: Invests in ‘Built in Africa for the World’ companies, leveraging proprietary deal flow data.

$664M VC Funds: Invests in top-performing venture funds and companies across sectors, geographies, and blockchain.

$60M VC Fund: Invests in creator-led businesses across multiple verticals, emphasizing brand and content-driven growth.

$6.3M first closing: VC focuses on sovereign early-stage startups with military applications, excluding controversial weapons.

$190M VC Fund: Invests in early-stage companies and technologies through its Venture and Growth Capital fund.

In February 2025, we also counted 12 new private equity fund closings totaling $17.83 billion

$270M PE Fund: Focuses on healthcare and B2B services investments across the U.S.

$160M PE Fund: Invests in technology and service sectors, focusing on UK and Irish markets.

$1.89B PE Fund: Invests in middle-market software businesses across Europe, supporting scaling into industry leaders.

$370M PE Fund: Focuses on lower-middle-market healthcare, industrials, and business services investments.

$615M PE Fund: Focuses on private equity co-investment opportunities, partnering with sponsors and businesses.

$3.6B PE Fund: Invests in middle and lower-middle-market opportunities in business services, finance, healthcare, and tech.

$8B PE Fund: Growth equity firm specializing in software and technology-enabled services investments.

$622M PE Fund: Partners with top-tier private equity sponsors to invest in U.S. mid-market buyouts and growth equity.

$125.5M PE Fund: Invests in lower-middle-market companies serving the utilities and government contracting sectors.

$235M PE Fund: Invests in business services, healthcare, and tech-enabled services, consistent with its prior funds.

$999.9M PE Fund: Focuses on energy sector investments, from upstream to midstream opportunities.

$950M PE Fund: Targets late-stage and early-stage companies needing capital to scale into global players.

Did our fund tracker miss anyone in February?

Let us know about any missing VCs or PEs by emailing us at hi@capvisory.de.

P.S. We’re always trying to keep track of all relevant funds to keep our internal investor CRM — tracking 20,000+ investors globally — up-to-date. This resource helps us to kickstart investor funnel creation for every fundraising and M&A project.

- VentureCapital

- PrivateEquity

- StartupFunding

- GrowthJourney

- Fundraising

- MergersAndAcquisitions

- Capvisory